You are here

Back to topFDK China Market Update — Week 31

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

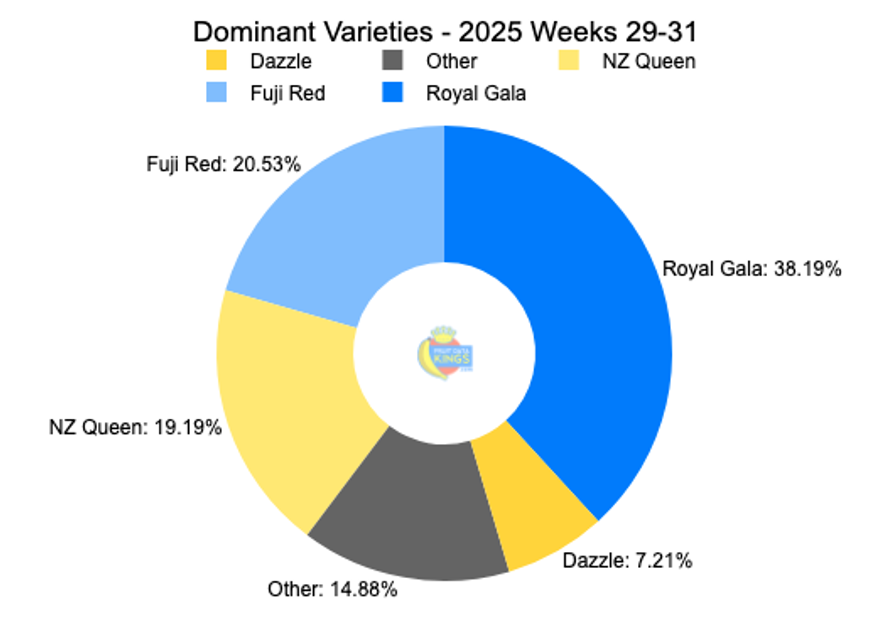

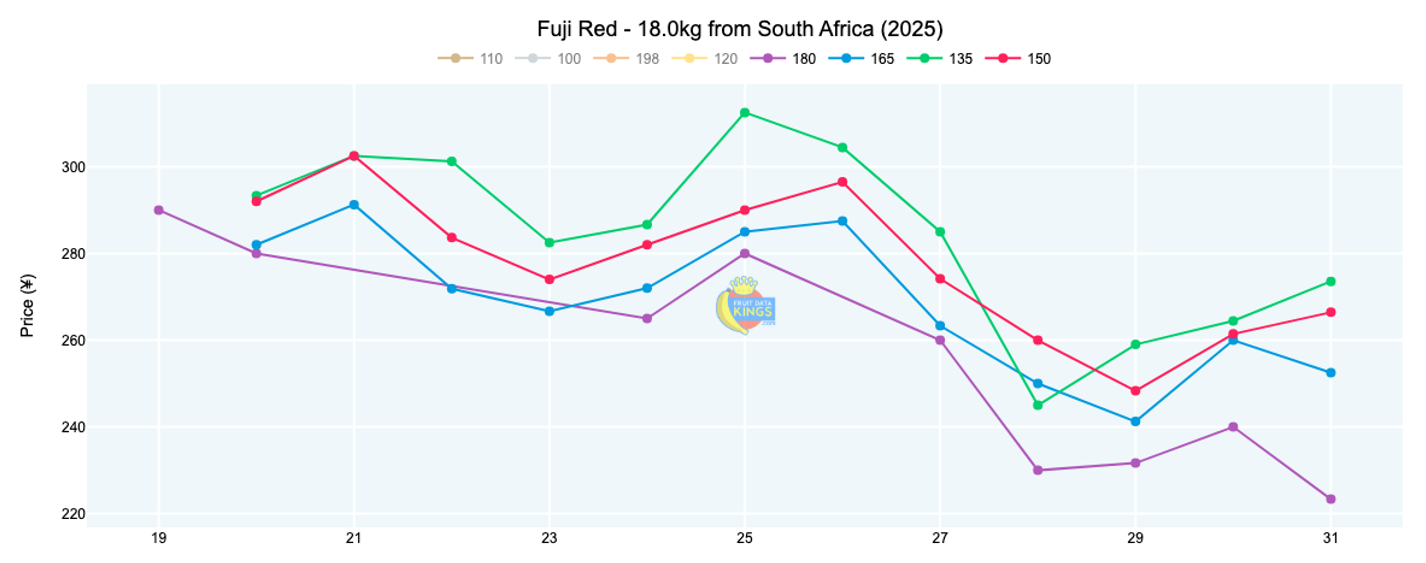

Apples (⇨)

New Zealand remains the leading origin with 59% dominance over the past three weeks, though volumes decreased overall. Royal Gala prices lifted to ¥299 (18 kg) yet remain 7% below last year’s levels. South African Fuji Red traded at ¥255 (18 kg), about 10% firmer than last season. Chilean Royal Gala saw strong pricing, but this was brand specific. NZ Queen averaged ¥308 (18 kg) but remains 5% softer than a year ago. View market data.

Blueberries (⇨)

Small volumes of Peruvian goods have been entering the market. An enormous price range exists between the lower-end and higher-end sizing (14 mm vs. 18 mm+). Emerald and Madeira opened at values of between ¥110 and ¥170+ (1.5 kg), depending on the size. In retail, we have recorded an average sales price of ¥17.85 (125 g) across a basket of eight retail chains (including Walmart, AEON, RT-Mart, Vanguard, Pagoda and more). View market data.

Grapefruit (⇧)

South African Star Ruby maintains its single origin position. Pricing remained level at just shy of ¥160 (15 kg, various sizes). This is now 32% higher than the same week of last season. View market data.

Lemons (⇧)

On the import front, South Africa leads in dominance; however, domestic lemons retain firm control. In the retail segment, we see pricing hover between ¥32 and ¥40 (1 kg) in a basket of key retailers. In wholesale, South African lemons have reached an average value of ¥287 (15 kg), which is a full 80% above 2024. Full details are available to members. View market data.

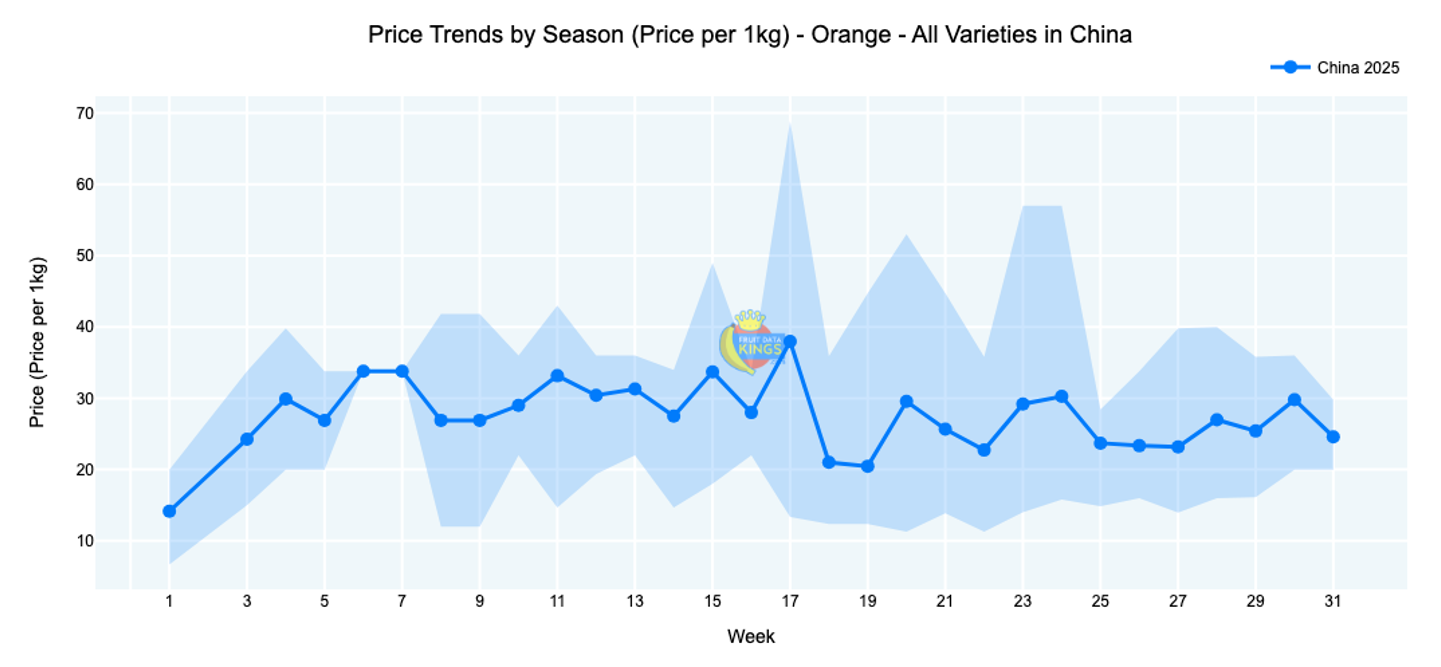

Oranges (⇩)

Overall, the market shifted downward this week across all suppliers. South African Valencia prices are now approximately 29% below the same week of 2024; however, this is actually the same as the 2023 price trend. Midknight is also currently priced around the 2023 values. Australian navels also weakened to ¥234 (18 kg, various sizes), down 18% year on year. Egyptian Valencia is finishing off with pricing considerably lower than what it has achieved in the past nine weeks. In retail, we have recorded an average sale price of ¥24.59/$3.41 (1 kg). Full details are available to members. View market data.

Soft Citrus (⇩)

South Africa dominates the soft citrus market with volumes increasing overall. Tango prices eased to ¥154 (10 kg), now 26% below last year. Nadorcott also softened to an average of ¥152 (10 kg) and is following the 2023 trendline. To view full details including Peruvian Tango and Australian Murcott, visit us online. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment