You are here

Back to topFDK China Market Update — Week 36

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

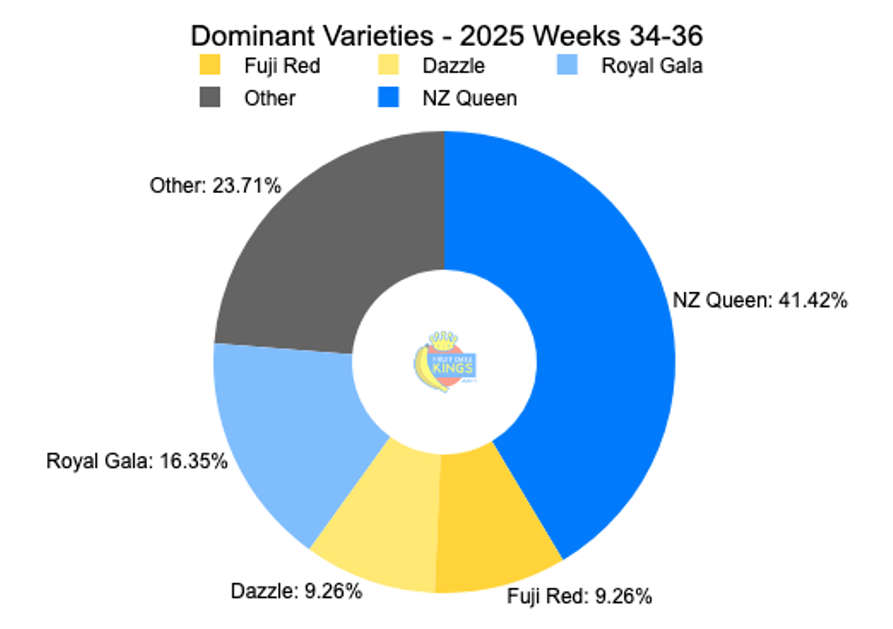

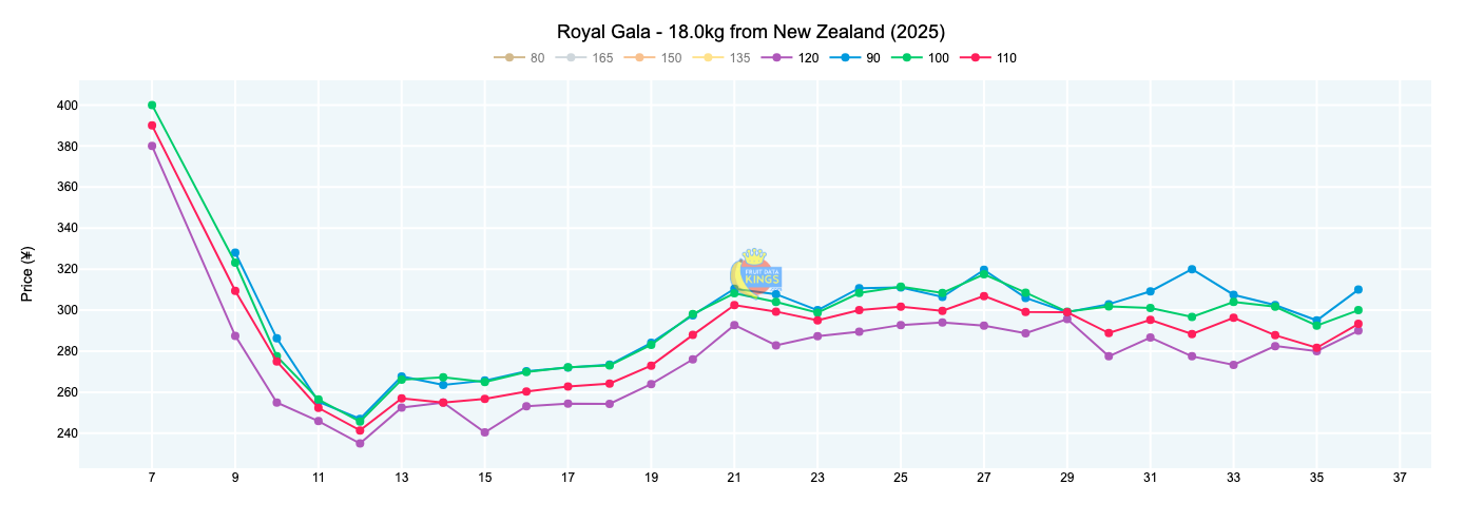

Apples (⇧)

We are approaching the end of the Southern Hemisphere apple season with New Zealand continuing to dominate the segment, accounting for about 70% of apple openings over the last three weeks. NZ Royal Gala lifted in price this week and averaged around ¥298 (18 kg), up ¥13 from last week but still trading 14% below last year. Overall, it has been a challenging season for most origins and varieties, with pricing either below the previous two years or similar to them. For full details as well as South African, New Zealand and Chilean specifics, visit us online. View market data.

Avocados (⇧)

Wholesale pricing lifted for avocados this week, dominated by Peru and followed by Kenya. This improved market was entirely supply related as there were fewer goods available. Currently, the average retail price sits at ¥66.72 per kilogram, which is up strongly compared with week 35. View market data.

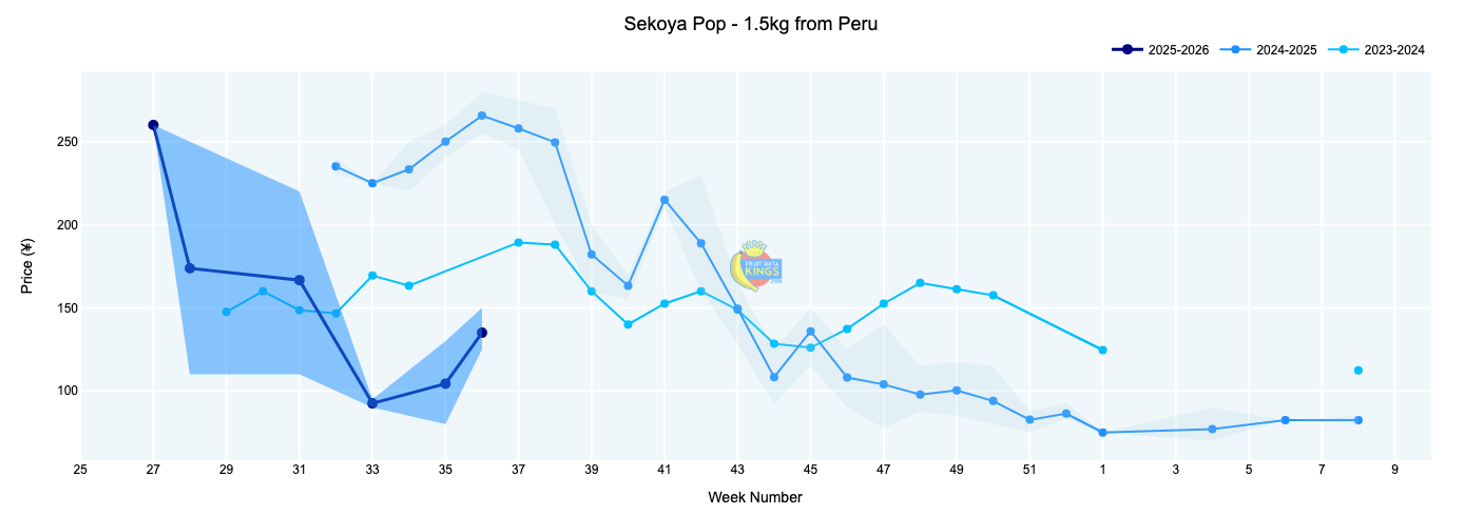

Blueberries (⇧)

Peruvian blueberry prices showed strength this week and generally lifted. There remains a wide range of varieties on offer, with Sekoya Pop, Biloxi, Venture, April Blue and others available to buyers. Pricing, however, remains lower than the previous two seasons across all varieties, and this is due to supply dynamics with China offering a good quality product locally. Sekoya Pop was trading roughly 49% below the same week of last year, while Biloxi was in a similar situation of 40% below. In a selection of retailers, an average value of ¥15.00 (125 g) has been recorded, which is below last year’s value of ¥17.25 (125 g). View market data.

Grapefruit (⇧)

South African Star Ruby pricing strengthened to ¥171 (15 kg), up ¥19 from last week and trading 27% above last year’s levels. Further details including brands are available online. View market data.

Lemons (⇨)

The China lemon market remains robust with pricing strongly above the previous two seasons. This week’s pricing has remained steady and is still over 40% higher than the same week of last year. Full price by size details as well as retail pricing are available to members. View market data.

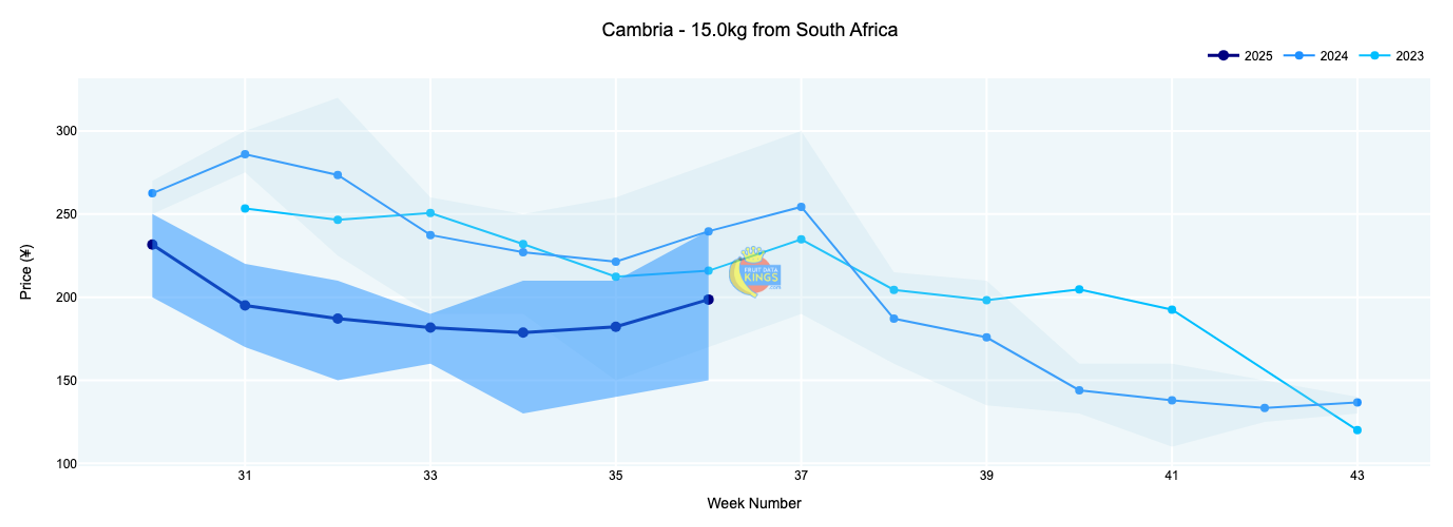

Oranges (⇧)

The market for oranges lifted this week, especially for South African navel types such as Cambria and Witkrans. Despite the strong improvement, we continue to record prices as mostly below the previous two seasons. From week 30 to 35, these two navel types have been priced 20% to 30% below 2024. Valencia and Midknight dominate the offering, both of which have been following the lower 2023 levels and are currently 21% below last season, with Valencia at approximately ¥136 (15 kg, various sizes) and Midknight at ¥157 (15 kg, various sizes). Australian navels find themselves in a tricky situation in this challenging market, as South African 17-kilogram cartons also offer an attractive alternative and 400-kg bulk shipments have been becoming more common and may also shift perceptions in buyers. View market data.

Soft Citrus (⇨)

There was mixed price movement this week for both Australian and South African soft citrus. Overall, South African Nadorcott is one of the most dominant varieties on offer followed by Australian Phoenix. Nadorcott pricing lifted by approximately ¥10 this week and was trading slightly above last season, while Phoenix remained rather stable at ¥324 (18 kg), which is similar to the level seen in 2024. Full details are available online. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment