You are here

Back to topChina’s Tree Nut Imports Down 38% in First Half of 2025

According to the China: Tree Nuts Annual report recently released by the U.S. Department of Agriculture’s Foreign Agricultural Service, China’s domestic production of tree nuts, particularly walnuts, macadamia nuts and hazelnuts, continues to rise owing to increased demand driven by growing consumer awareness of their nutritional and health benefits. Although economic headwinds and tariffs on U.S. tree nuts may dampen consumption growth in the short term, the Chinese tree nut market retains strong long-term growth potential.

Tree Nut Imports

According to the International Nut and Dried Fruit Council, China’s domestic production of tree nuts, including walnuts, macadamias and hazelnuts, has grown at a compound annual rate of 9% over the past five years. Despite this growth, China remains heavily reliant on imports to meet domestic demand, particularly in the case of pistachios, almonds and pecans. Data from the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce and Animal By-Products show that China imported over 600,000 metric tons of tree nuts in 2024, a 21% year-on-year increase. However, additional tariffs on U.S. tree nuts caused the import volume to drop by 38% in the first half of 2025, and tariff policies continue to create considerable uncertainty for nut traders.

Pistachios

Trade Data Monitor reports that China was the world’s second-largest pistachio importer (in-shell basis) in 2024, after the European Union. Despite a strong crop in California, the world’s leading production region, China’s imports of both raw and processed pistachios from the United States are expected to decline sharply in the 2025/26 season on account of high tariffs. Meanwhile, China’s imports from Iran, the country’s second-largest supplier, are anticipated to continue rising as Iran’s supply outlook improves.

Almonds

In 2024, China was the world’s third-largest almond importer (shelled basis), after India and the European Union. Tariff-related increases in transport costs from the United States are expected to drive a sharp decline in China’s almond imports. Although a significant volume of U.S. raw almonds is projected to be processed in Southeast Asia before being re-exported to China, industry insiders remain concerned that processing capacity in the region is limited compared with China, particularly during peak demand periods. Meanwhile, China may increase its almond imports from Australia and Spain, both of which are also anticipated to see higher production in the 2025/26 season.

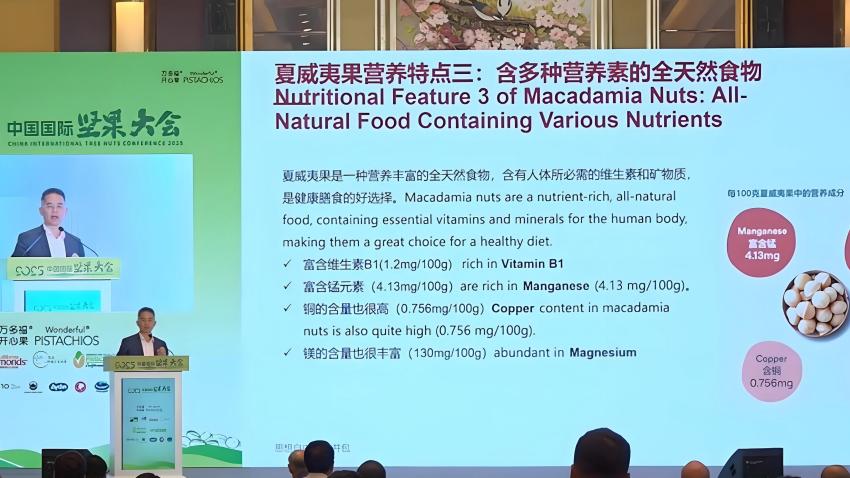

Macadamias

With domestic production reaching a record high, China’s imports of macadamia nuts are forecast to decline in the 2025/26 season. Industry reports indicate that South Africa is the largest supplier, with over 50% of its 2024/25 production shipped to the Chinese market. Australia is another key supplier, with export volumes to China remaining stable.

Pecans

China’s domestic demand for pecans is growing rapidly, yet the country remains highly dependent on imports. In the 2024/25 season, global supply, particularly from the United States and Mexico, declined, resulting in a 30% drop in China’s pecan imports. This decrease is also attributable to China’s additional tariffs on U.S. nuts. Looking ahead to the 2025/26 season, pecan imports from South Africa and Mexico, now the two leading suppliers, are expected to rise, while the U.S. share is likely to continue shrinking.

Walnuts

China’s walnut imports remain low and continue to decline owing to ample domestic supply. Imports from the United States and Chile primarily target premium consumer segments.

Tree Nut Exports

According to the International Nut and Dried Fruit Council, China’s tree nut exports, mainly walnuts, have increased at a compound annual growth rate of 9% since 2015. Data from the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce and Animal By-Products show that total exports reached 320,000 metric tons in 2024, up 23% year on year. Growth accelerated in the first half of 2025, with exports rising by 62% compared with the same period of 2024.

Walnuts remain China’s dominant export product. Supported by increased supply, improved product quality and competitive pricing, walnut exports are expected to continue growing in the 2025/26 season. Trade Data Monitor reports that China’s walnut exports (in-shell basis) totaled 151,454 metric tons in the first seven months of 2025, up nearly 80% year on year. China now exports walnuts to more than 50 markets, primarily Belt and Road countries such as the United Arab Emirates, Turkey and Kyrgyzstan.

In recent years, China’s macadamia nut exports have also grown and are forecast to continue rising in the 2025/26 season, driven by strengthening demand in key markets such as Australia and the United States. Additionally, re-exports of both in-shell and shelled pistachios have expanded rapidly in recent years, especially to Southeast Asia, Hong Kong and Germany.

Image: Pixabay

This article was based on a Chinese article. Read the original article.

Add new comment