You are here

Back to topPeruvian Blueberries Facing Rollercoaster Season in China

Peruvian blueberry prices in China have been swinging dramatically this season. Shipments entered the market in early July while domestic Chinese blueberries were still plentiful, creating intense price competition, despite industry insiders confirming that Peruvian exporters typically adjust their shipments based on the availability of Chinese blueberries.

In July, the blueberry-growing region of Dandong in Liaoning province experienced heavy rains. Predicting a drop in domestic supply, Peruvian exporters increased their shipments to China, with customs records showing that 922.5 metric tons of Peruvian blueberries arrived that month. However, the yields in Dandong actually exceeded the initial forecasts and the rain-affected fruit had a shorter shelf life, forcing faster sales. This oversupply had the effect of pushing prices down.

Shipments of Peruvian blueberries surged further in August, reaching 4,588.4 metric tons. By the middle of the month, the market price for standard small-sized fruit had fallen to 60 yuan ($8.43) per box, with retailers in some second-tier cities offering prices as low as 4 yuan ($0.56) per 125 grams. Early-season Peruvian blueberries had also been affected by the weather and were more acidic than usual, further depressing prices.

.png)

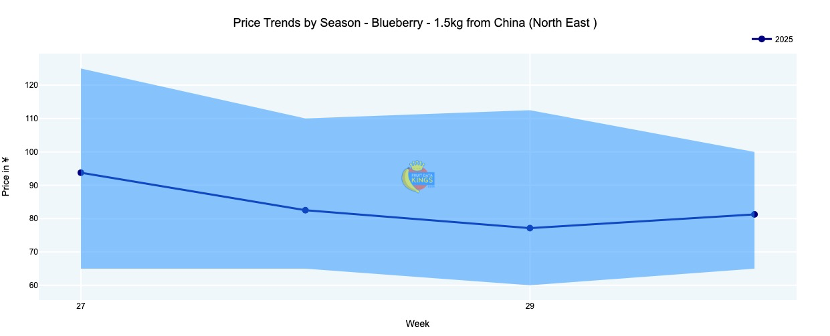

Data from the fruit price platform Fruit Data Kings show that prices rebounded toward the end of August and in early September owing to temporary supply shortages. The supplied varieties included Sekoya Pop, Biloxi, Venture and April Blue. However, because Chinese consumers tend to prefer sweeter domestic blueberries, market pricing for the more acidic Peruvian varieties remained lower than in the past two seasons. Sekoya Pop prices were down by 49% year on year, while Biloxi prices fell by 40%. Some retailers were selling blueberries for just 15 yuan ($2.11) per 125 grams, compared with last year’s 17.25 yuan ($2.42).

Peruvian blueberry industry insiders have noted that the Chinese market operates differently from Europe and the United States, where large retailers dominate pricing. In China, wholesale markets control prices, which can fluctuate rapidly.

Peruvian blueberry shipments are generally lower during the first half of the year, with over 85% of exports typically occurring between July and December. By the end of the season, exports are projected to have exceeded 400,000 metric tons, corresponding to a volume increase of nearly 25%. However, with competition driving down prices, the total export value is anticipated to grow by only 8–13%.

To cater to Asia’s demand for large, high-quality blueberries, the Peruvian blueberry sector has introduced new authorized varieties such as Ibus, Colossus, Magnus, Keecrisp and FL19-006. Each variety is tailored to specific production windows and consumer preferences, allowing exporters to serve the high-end market without oversaturating supply.

For Peruvian blueberries to remain competitive globally, the industry must continue introducing new varieties, diversify its export markets and address logistical challenges. Currently, the United States remains the main export destination, but with the newly opened Chancay Port expected to be fully operational within three years, shipping times to Asia will be greatly reduced, reducing Peru’s dependence on the U.S. and European markets.

Images: Pixabay (main image), Fruit Data Kings (body images)

This article was translated from Chinese. Read the original article.

Add new comment