You are here

Back to topFDK China Market Update — Week 39

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

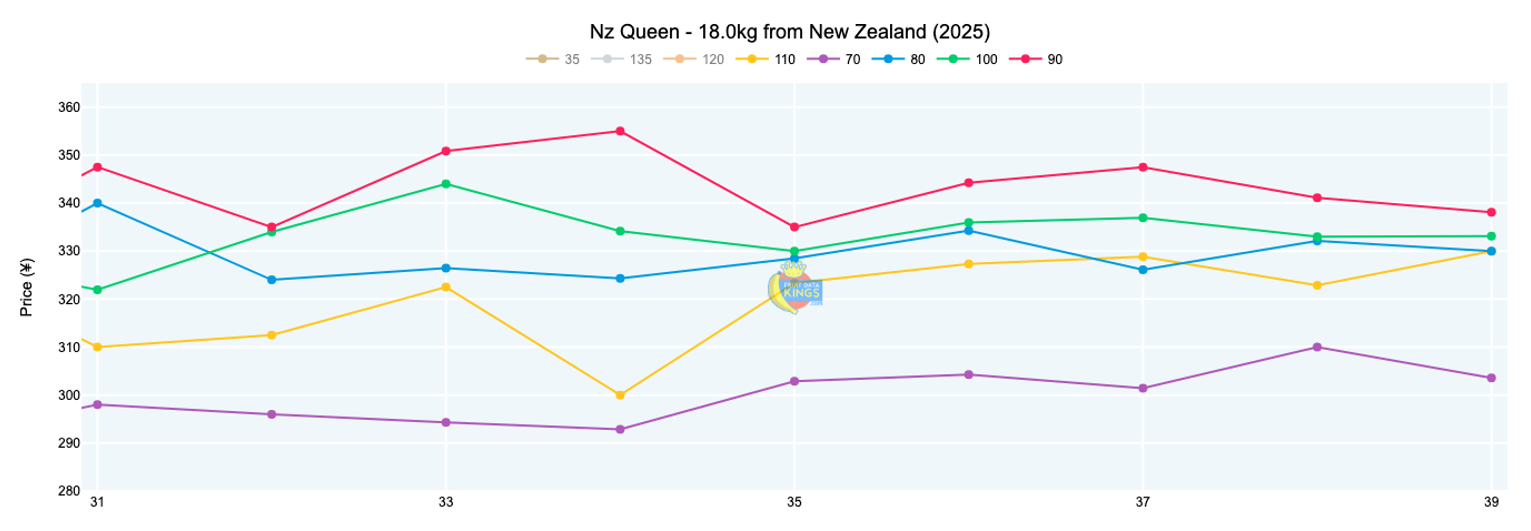

Apples (⇧)

Over the last three weeks, New Zealand has continued to dominate the import segment at 78% of arrivals, with NZ Queen leading at 48% of the variety share. NZ Royal Gala prices firmed to an average value of ¥310 (18 kg), while Dazzle reached ¥406 (18 kg, various sizes). NZ Queen prices lifted to an average of ¥323 (18 kg), trading around 17% higher than 2023 but still visibly below the 2024 season. View market data.

Avocados (⇨)

Peruvian avocados continue to dominate the market. Wholesale pricing remains elevated compared to the lows recorded in weeks 33 and 34. Chilean goods are trickling into the market, while the occasional shipments of Kenyan goods are being opened too. Access to reliable retail channels remains important, and the average retail price across seven retailers currently stands at ¥60.57 (1 kg). View market data.

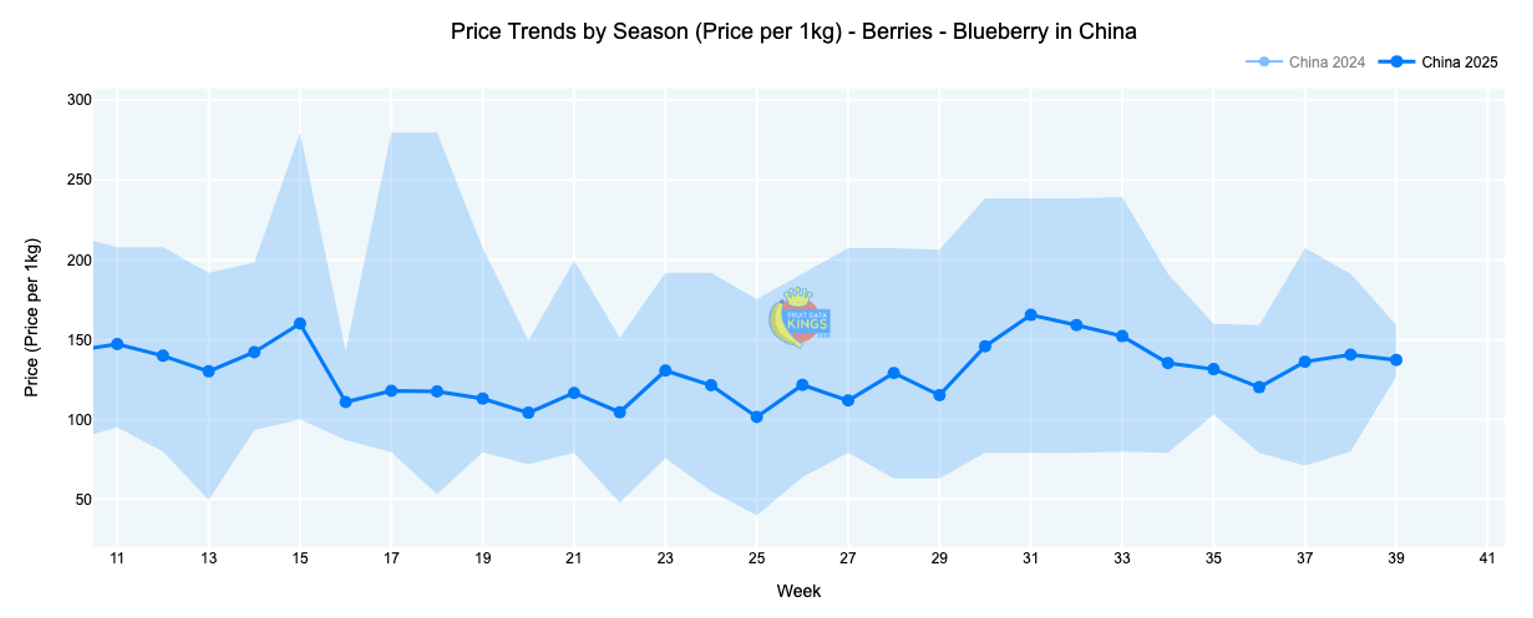

Blueberries (⇩)

Sekoya Pop and Magica are currently the leading variety offerings. Wholesale pricing continues below the levels of the previous two seasons across all varieties. At the retail level, domestic blueberries remain very active, including those packed in worldwide brands. However, the average retail price point for Peru and China is hovering between ¥16.25 and ¥20.00 (125 g), which is 20% below what we have on record for the same week of 2024. View market data.

Grapefruit (⇧)

South African Star Ruby is finishing off strong this season with a price point around ¥186 (15 kg) in week 39. As a result, pricing sits 47% firmer than last year, though still 7% below the 2023 season. View market data.

Lemons (⇨)

The lemon market remains robust this week with pricing holding steady, similar to week 38. Full details including retail pricing are available to members. View market data.

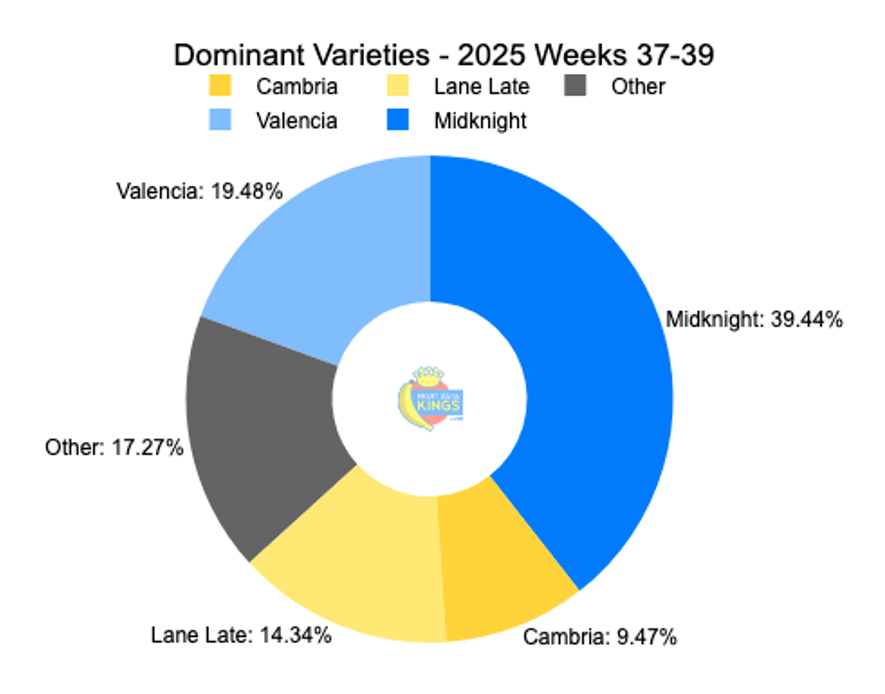

Oranges (⇩)

At the wholesale level, South Africa leads with more than 70% market share over the past three weeks. Valencia pricing has softened to ¥131 (15 kg), while Midknight declined to ¥140 (15 kg); these values are both in line with the previous two seasons. Australian Lane Late remained steady at ¥319 (18 kg). At the retail level, we are seeing an average value of ¥15.20 (1 kg), which is lower than the same week of last year. View market data.

Soft Citrus (⇩)

Australia and South Africa are splitting the market, with multiple varieties active. South African Nadorcott declined sharply to average ¥147 (10 kg), while Australian Honey Murcott eased to an average value of ¥355 (18 kg), which is below the previous two seasons. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment