You are here

Back to topFDK China Market Update — Week 33

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

Avocados (⇨)

The avocado market remains rather challenging with quality a key contributor to the situation. Most Peruvian goods were trading at between ¥50 and ¥60 (4 kg, 20–24), with lower-quality produce sitting at ¥45 (4 kg). In retail, we see Peru clearly dominating the market. View market data.

Apples (⇨)

New Zealand dominates with 56% market share over three weeks, while South African arrivals increased to 33%. NZ Queen averaged ¥306 (18 kg, various sizes) with Royal Gala at ¥289 (18 kg, various sizes), both showing modest weekly increases despite trading 16% and 11% below last year, respectively. South African Fuji Red was trading similar to last week. Specific wholesale details as well as retail pricing are available to members. View market data.

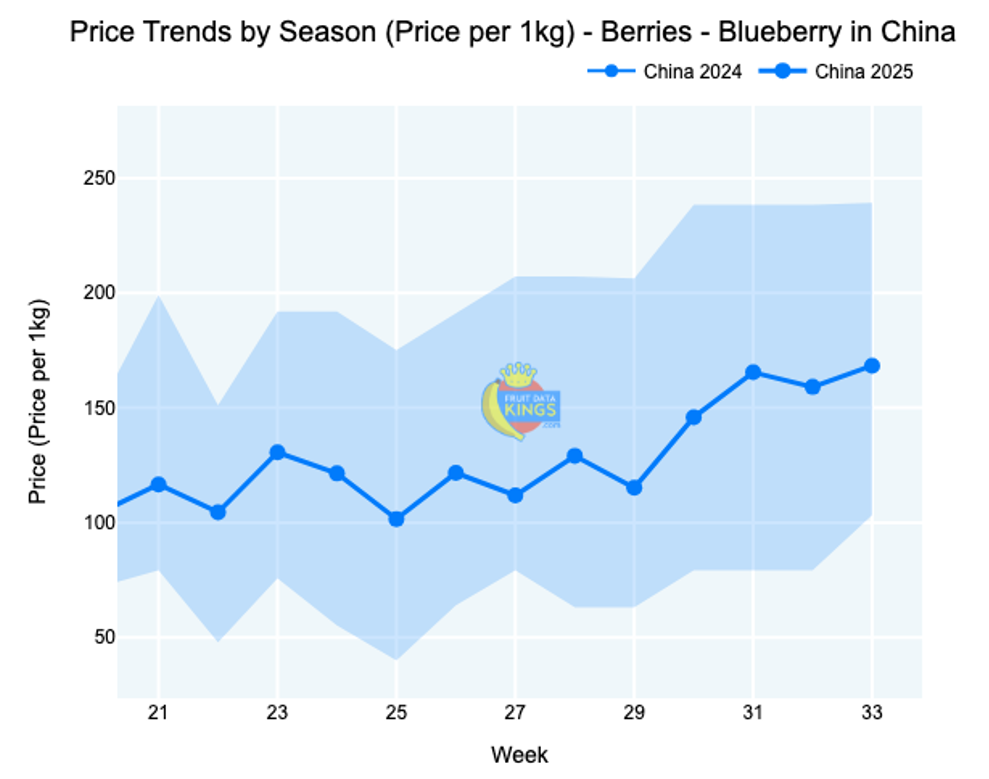

Blueberries (⇨)

Peruvian supply is gradually picking up while domestic goods remain readily available. During the week, we recorded average pricing at ¥60 (1.5 kg, 14+ mm) and ¥110 (1.5 kg, 18+ mm) for domestic goods. In retail, we noted an average price of ¥21.00 (125 g) when considering a basket of five retailers; details are available online. View market data.

Grapes (⇨)

In Chinese retail, overall grape pricing was stable this week at ¥31.95 (1 kg) and is rather similar to the same week of last year at ¥34.95 (1 kg). Visit us online to find specific retailer prices. View market data.

Grapefruit (⇨)

South African Star Ruby maintains complete market control with pricing steady with respect to last week. Pricing remains above the 2024 season by 17%. View market data.

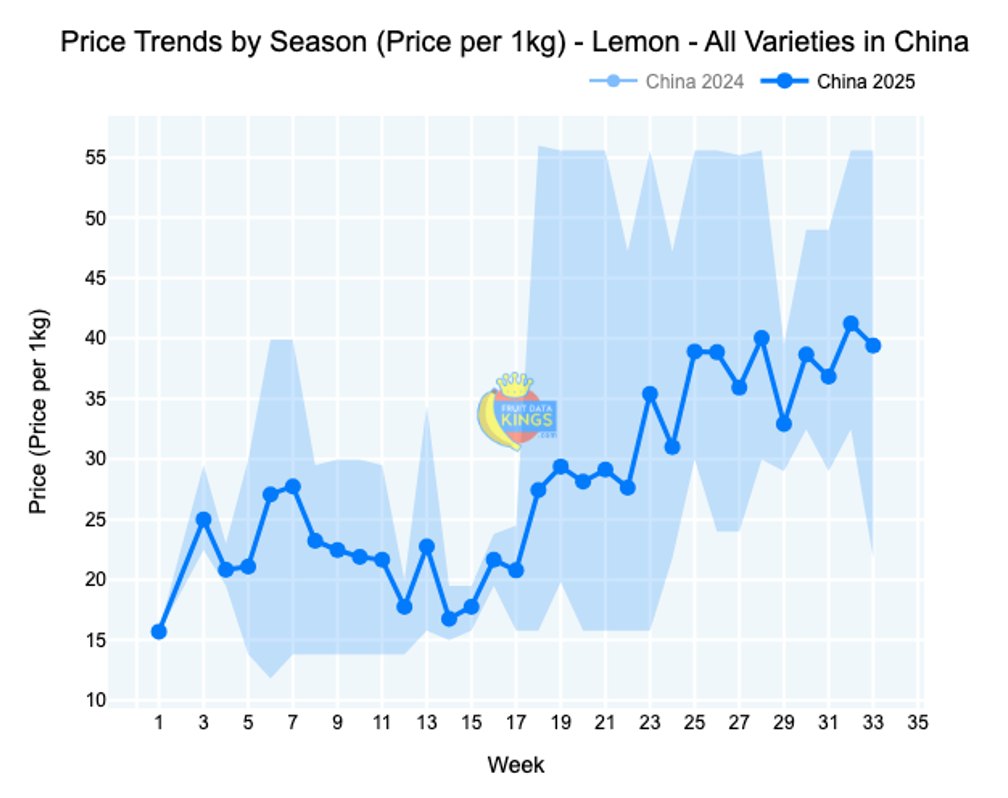

Lemons (⇨)

South African and Chilean goods are both available in the market. Overall pricing for South Africa is 55% higher than last season and similarly above the 2023 season. Full details are available online. View market data.

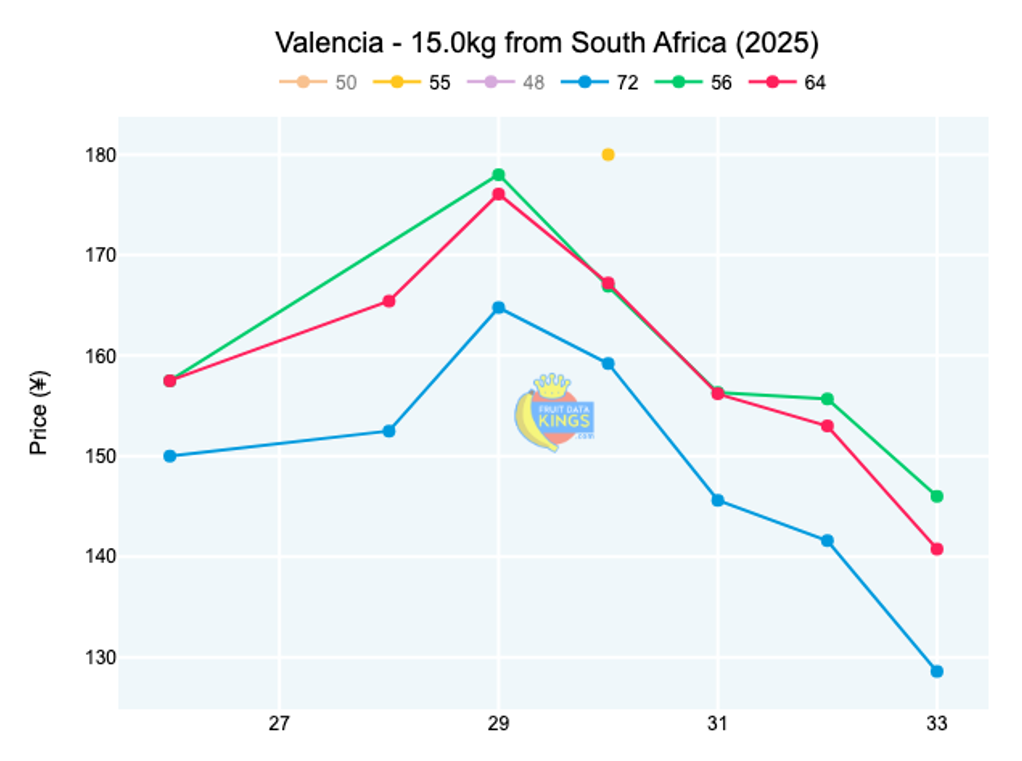

Oranges (⇩)

The market continued adjusting to increased supply with South Africa maintaining 69% dominance over three weeks. Valencia retreated to ¥140 (15 kg), representing a steep 26% decline from the same week of last year, while Australian navels firmed to ¥236 (18 kg) yet remained 19% below last season’s pricing. Midknight was also trading around 21% below 2024. View market data.

Soft Citrus (⇩)

Market dynamics shifted as volumes increased. Nadorcott weakened to ¥128 (10 kg, various sizes), now trading 20% below last year’s value, while Tango stabilized at ¥122 (10 kg, various sizes) despite being 27% under the levels of the previous season. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment