You are here

Back to topFDK China Market Update — Week 21

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

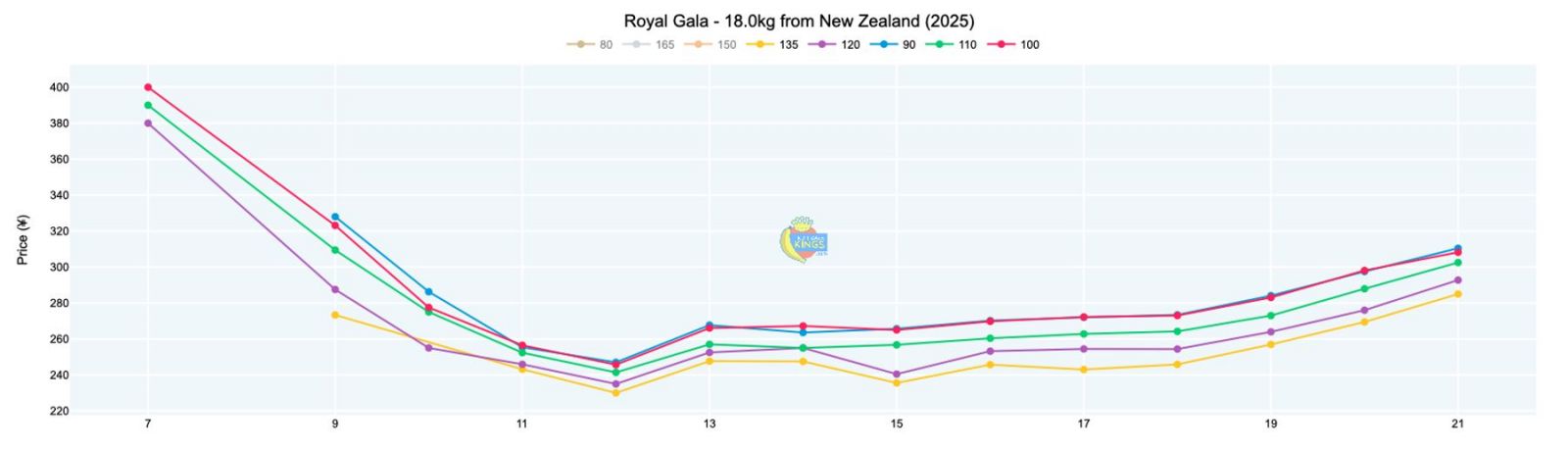

Apples (⇧)

New Zealand maintains its strong presence in the apple market, commanding 65%+ of container openings in southern China over the past three weeks, with this share increasing further during week 21. South African apples follow, holding about 19% of the three-week volume. NZ Royal Gala prices saw an uplift, averaging around ¥300 (18 kg), a notable increase from the previous week and trending higher than 2023 but still below 2024. NZ Queen also experienced a positive shift, with prices firming to an average value of ¥320 (18 kg). South African Fuji Red showed significant price recovery, averaging ¥298 (18 kg). Further wholesale and retail specifics are available on our website. View market data.

Grapes (⇩)

The grape market is primarily supplied by Chile and Australia. Chilean Red Globe prices continued their downward trend, settling near ¥122 (8.2 kg), a considerable drop from the last week and significantly below 2023’s levels and also close to the values seen last season at the tail end of the supply window. Australian Crimson also saw prices ease, averaging ¥160 (9.5 kg), markedly lower than the same period of the previous two years. Imported grape details in HeMa, Walmart, Wumart, AEON, RT-Mart, Vanguard and others can be found online by members. View market data.

Grapefruit (⇩)

South Africa remains the sole origin for grapefruit in the market. Prices for South African Star Ruby pulled sharply downward this week, averaging ¥207 (15 kg). Despite this decline, current values are notably firmer compared to the same period of 2023 and are also firmer than 2024. View market data.

Oranges (⇧)

Egypt and the United States are the main origins for oranges. Egyptian pricing lifted this week, with the average value for Valencia oranges settling at ¥150 (15 kg), a positive shift from the prior week and notably stronger than last year. The United States, primarily with varieties like Lane Late, continues to hold a significant share of the market, particularly for the higher-value segments. View market data.

Soft Citrus (⇧)

Kicking off the season, the first Australian mandarins have been received with Royal Red Murcott opening for prices between ¥210 and ¥230 (9 kg, #48-64s). View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body image)

Add new comment