You are here

Back to topSevere Drought and Disease Drive Brazil’s Orange Harvest to 37-Year Low

Brazil’s orange production is expected to reach its lowest level in more than three decades this season as farmers struggle with adverse climate conditions and continued outbreaks of citrus greening disease.

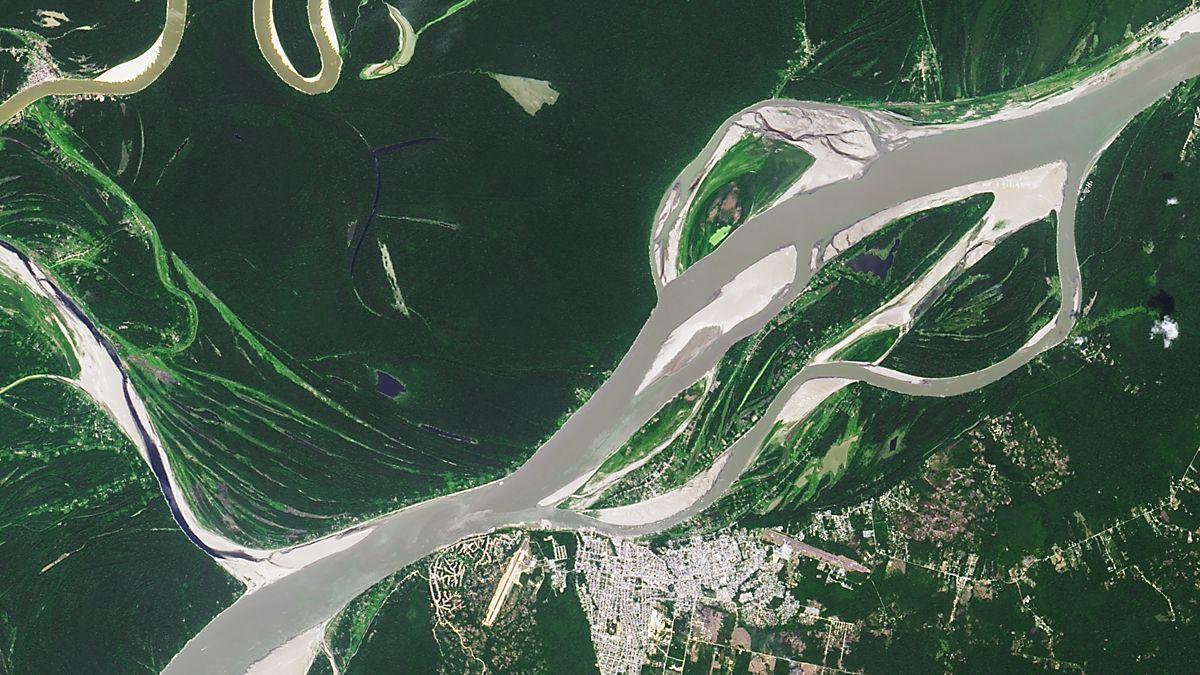

Extreme drought in the country has led to widespread drying of rivers throughout the Amazon basin. According to a report released by Brazil’s National Center for Monitoring and Early Warning of Natural Disasters (CEMADEN), water levels in the basin have fallen to historic lows as the country experiences its most severe drought since records began in 1950. The drought-affected area now covers 5 million square kilometers — over 58% of Brazil’s land area — with more than one-third of the country experiencing extreme drought.

Brazilian meteorologists noted that while the dry season typically lasts from August to October, the persistence of the current drought has broken this usual pattern. The prolonged drought has led to a significant loss of soil moisture, and the declines in river, lake and groundwater levels have put tremendous pressure on the country’s water supply and reserves. Even with the return of rainfall in late October, the current orange crop remains below the usual quality.

The lower river levels have also interrupted inland water navigation and impacted hydropower generation, while exacerbating pest infestations. In late 2023, Brazil’s key orange-producing regions of São Paulo and Minas Gerais experienced 11 consecutive days of extremely high temperatures exceeding 35 degrees Celsius. Coupled with a widespread outbreak of citrus greening disease, orange production in these regions has plummeted.

One plantation owner in the municipality of Casa Branca in the state of São Paulo reported that more than 80% of local orange trees were infected with citrus greening disease, causing a 30% drop in per-hectare yields. Forecasts from Brazil’s citrus industry anticipate a 24% decline in production for the 2024/25 orange harvest, with the projected yield of 232.38 million boxes (40.8 kilograms) marking the lowest output since 1988/89. This fall in production has led to a surge in orange prices in Brazil from 45 Brazilian real ($7.74) per box last year to 80 real ($13.76) per box in 2024, an increase of 78%.

Brazil is the world’s largest orange juice exporter, supplying over 70% of the global market. The decline in orange production has naturally led to a substantial decrease in the global orange juice supply, with prices rising by over 50% since early 2024. In early September, orange juice futures reached $4.92 per pound, nearly three times higher than just two years ago. This increase not only raises costs for consumers but also puts pressure on processors, distributors and other intermediaries in the orange juice supply chain.

The British Fruit Juice Association has also reported that orange juice availability is at its lowest in over 50 years. As a result, countries that have traditionally relied on importing Brazilian orange juice may need to seek alternative suppliers, potentially boosting exports from other major producers such as South Africa. However, building new trade relationships and supply chains will take time, leaving the global orange juice market unstable in the near future.

Image: NASA

This article was based on a Chinese article. Read the original article.

Add new comment