You are here

Back to top2021/22 South African Table Grape Season Concludes With Intakes Up

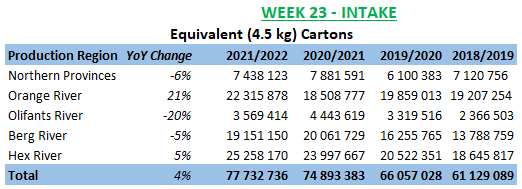

The 2021/22 South African table grape season has officially concluded, with volumes up slightly compared with last season, according to South African Table Grape Industry (SATI). This season’s production of export-ready table grapes reached 77.7 million cartons (349,650 metric tons at 4.5 kilograms per carton), an increase of 4% over the 2020/21 season, reported SATI. The Orange River and Hex River regions contributed most to this overall increase, with volumes up 21% and 5%, respectively.

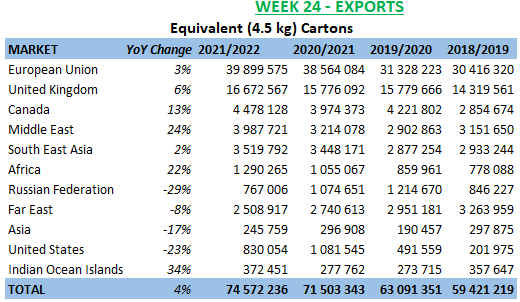

South Africa’s table grape intakes have been on a rising trend over the past three seasons. Production for 2019/20 was 66.1 million cartons, which then rose to 74.9 million cartons for 2020/21 before reaching 77.1 million cartons for the recently concluded 2021/22 season. Exports have also been on the rise, going from 63.09 million cartons for 2019/20 to 74.57 million cartons for 2021/22. Conversely, over the same period, the plantation area fell from 21,798 hectares to 20,564 hectares.

2021/22 SEASON STATISTICS

The following is a condensed and edited version of statistics and analysis for the 2021/22 season provided by SATI.

Intake up to Week 23 and Exports up to Week 24 (Accumulative)*

*Intake: Produce inspected and passed for export (PPECB data). Exports: Produce is seen as exported once the ship leaves South Africa’s shores (Agrihub data).

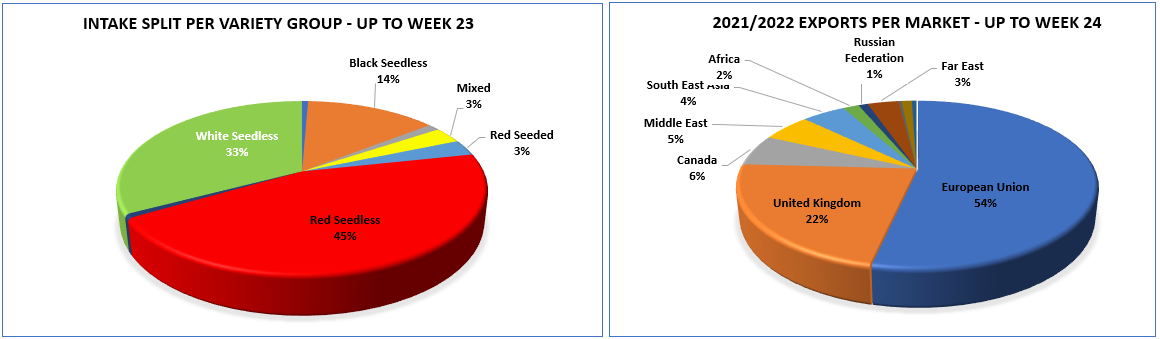

Cultivar Production

- Red seedless grape production decreased from 48% to 45%.

- Black seeded grape production declined from 2% to almost 0%.

- Black seedless grape production increased from 13% to 14%.

- White seedless grape production rose from 30% to 33%.

Export Markets

In comparison to 2018/2019, the following shifts in export market proportions were noted:

- Exports to the European Union increased from 51% to 54%.

- Exports to Canada increased from 5% to 6%.

- Exports to the United Kingdom decreased from 24% to 22%.

- Exports to the Far East decreased from 6% to 3%.

When considering the international landscape, exports from Peru and Chile have been growing steadily.

Collective feedback from the industry for this season centered on three key themes: cultivar selection, balancing economic viability and crop load, and fine-tuning optimum harvest maturity dates.

In terms of peak weeks and logistics, logistical challenges this season resulted in longer travel times to most markets. Data indicate ship loads of typically more than 2,500 containers of pome fruit, stone fruit and table grapes between weeks 1 and 10. From the table grape industry perspective, it is important to continue to stress the importance of weeks 49 to 11, which display high volumes of table grape exports exceeding 1,000 containers per week. During weeks 3 to 10, these volumes increase and table grape exports peak, with more than 1,500 containers per week.

Together with Hortgro and the Fresh Produce Exporters’ Forum, SATI is continuing to collaborate with Transnet to address challenges at the Port of Cape Town. Major measures include deploying additional teams, increasing night shift operations, optimizing operations, provisioning more equipment and increasing maintenance frequency.

Images: SATI

This article was translated from Chinese. Read the original article.

Add new comment