You are here

Back to topPMA Fresh Connections China: Chile Expands Market Share in 2016

Held from March 15-17, 2017 at the Westin Bund Center in Shanghai, PMA Fresh Connections: China 2017 proved a resounding success. Ms. Mabel Zhuang, CEO of M.Z. Marketing Communications, PMA China Development Representative, and founder of Produce Report, delivered a keynote address to participants on the state of China’s imported fruit market and covered major changes in exporters’ shares of the mainland China and Hong Kong’s import market in 2016.

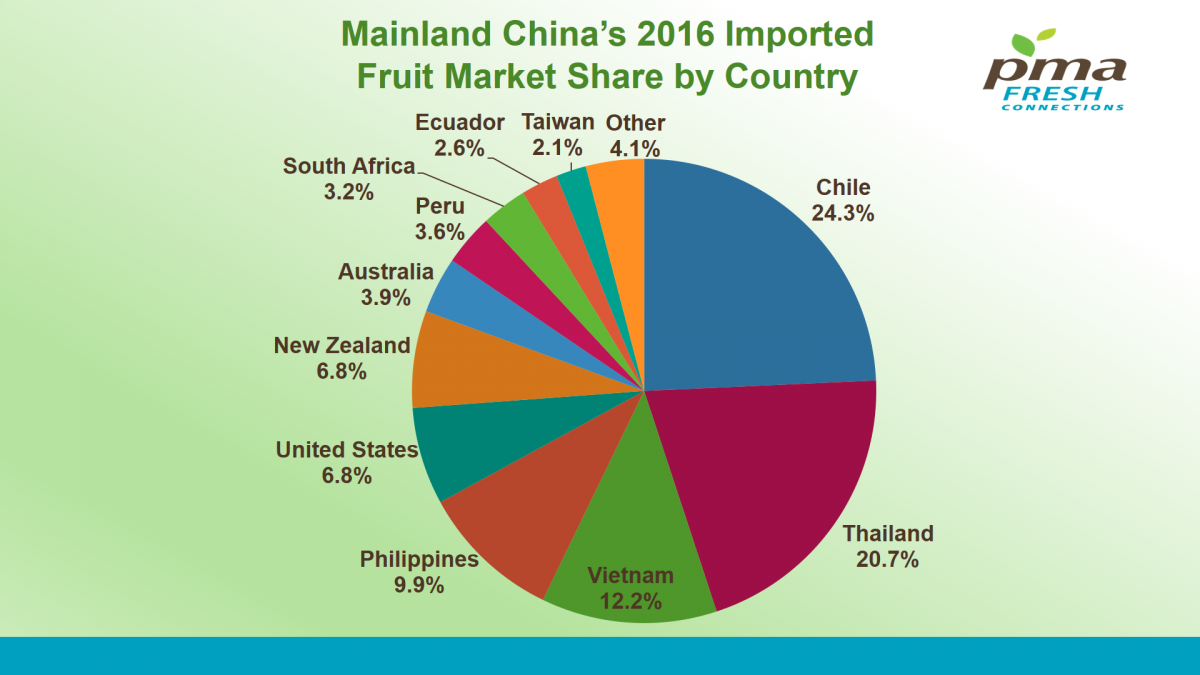

As covered earlier by Produce Report, 2016 was a year of significant growth for Chile’s fruit exports to China. Chile’s share of China’s imported fruit market by value grew by nearly 5% to 24.3%, surpassing Thailand’s 20.7% market share to take the largest slice of China’s imported fruit market pie. Oceanic countries also saw respectable growth, with Australia rising by 1.64% to 3.9% and New Zealand expanding by 1.26% to account for 6.8% of all imported fruit in China by value.

Vietnam witnessed its market share shrink drastically in 2016, as its share of China’s imported fruit market fell by almost 5% to 12.2%. Other losses included Ecuador, whose market share fell by 1.8% to 2.5%, and the Philippines, which gave up 1.4% to decline to 9.9%. Relatively unchanged were the United States (6.8%), Peru (3.6%), South Africa (3.2%), and Taiwan (2.1%); in total, these 11 countries and regions account for 95.9% of all fruit exports to China as measured by value.

In terms of volume, China’s imported fruit market saw a large decrease in 2016, falling over 300,000 tons to less than 3.5 million tons, or a decline of 8.2%. Mainland China’s imported fruit market as measured by volume is highly concentrated, as four countries account for fully 73.2% of the market (Vietnam, the Philippines, Thailand, and Chile). Vietnam remained the largest exporter of fresh fruit to mainland China by tonnage: 30.6% of all imported fruit in mainland China came from Vietnam in 2016, this despite falling 16.2% in 2016 to 1.07 million tons. The Philippines (19.7%) and Thailand (14.2%) also experienced declines in export tonnages in 2016, falling 8.3% and 15.9% respectively, but largely retained their 2015 percentage shares of the market.

Chile was once again the bright spot of China’s imported fruit market, as it was the only country in the top 5 exporters that recorded growth in 2016. Imports of Chilean fruit by volume grew substantially in 2016, rising by 28.3% to over 300,000 tons. Other significant changes in 2016 were Ecuador, which fell by 38.5% to 174,000 tons and gave up 2.46% of its market share to decline to just under 5%, as well as Australia, which rose by 56.6% to 82,000 tons and added nearly 1% to its previous share for a total market share of 2.3%.

After several years of relative stagnation, Hong Kong’s imported fruit market enjoyed remarkable growth in 2016, rising 17.9% in 2016 to $2.6 billion. As with mainland China, this was largely thanks to Chilean exports, which swelled by 69.3% to $758.6 million in 2016 and caused Chile’s share of Hong Kong’s market by value to rocket an incredible 8.8% to 29.1%. Imports from Thailand also grew in value by 11.5%, yet Thailand’s share of Hong Kong’s market actually dropped over 1% to 19.0%. Similarly, exports from the United States and Australia in 2016 actually grew in value (+0.28% and +9.41%, respectively) but declined in market share (-2.7% to 15.2% and -0.6% to 7.6%, respectively), largely due to Chile’s massive gains. These top four exporters to Hong Kong account for 61.7% of its entire imported fruit market, and the top ten exporters comprise 92% of all fruit imports into Hong Kong by value.

Hong Kong also saw marginal gains in total tonnage in 2016, rising 3.3% to 1.66 million tons. Chile led this growth with an impressive growth rate of 57.7%, climbing from fourth to second largest exporter to Hong Kong by weight and capturing 15.4% of the market, an increase of 5.3%. Thailand dropped both in terms of overall tonnage (-12.3%) and market share, losing 4.6% to drop to 25.9%, but retained the title of largest exporter to Hong Kong by volume. As with value, Hong Kong’s imported fruit market as measured by volume is dominated by four countries, who account for 67.7% of the market. In addition to Chile and Thailand, imports from mainland China and the United States are also substantial and saw modest gains in 2016, rising by 8.0% and 9.0% by tonnage for a total market share of 13.2% and 13.1%, respectively.

Add new comment