You are here

Back to topFDK China Market Update — Week 37

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

Apples (⇧)

We are fast approaching the closing week of the season. New Zealand remains the most active supplier with new containers still being opened at the wholesale level. Apple pricing generally lifted this week or stayed stable. NZ Royal Gala averaged ¥309 (18 kg), up from ¥298 last week; however, they are still trading 14% below last year’s level. NZ Queen remained level compared to the previous week in a very wide price range with an average value of ¥317 (18 kg, various sizes). South African Royal Beaut also showed improvement and was trading above last year’s level by about 7%. View market data.

Avocados (⇨)

Wholesale pricing remained rather steady compared to last week with Peruvian avocados clearly dominating the offering. This week saw the first arrivals from Chile, which were showing good quality and received movement at values around ¥150 (4 kg, various sizes). Further information regarding Yunnan Hass avocados is available to members. View market data.

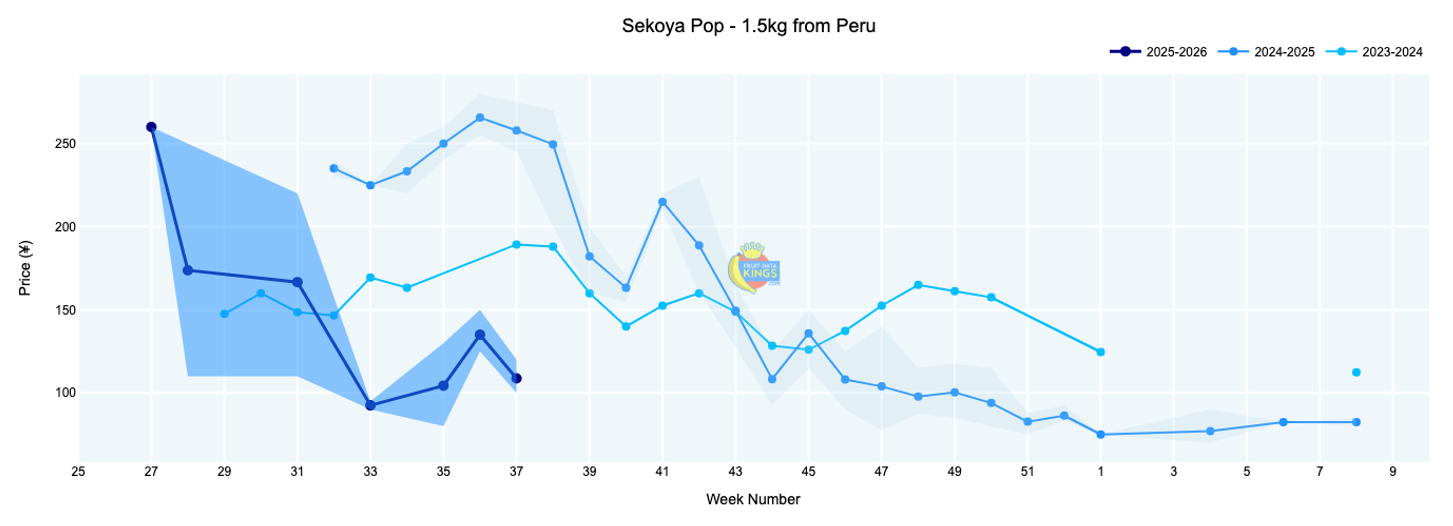

Blueberries (⇩)

While there was an improvement registered last week for imported goods, this week saw pricing readjust downward. As a result, all major varieties such as Biloxi, Magica, Sekoya Pop and Ventura are priced below the levels of the previous two years. View market data.

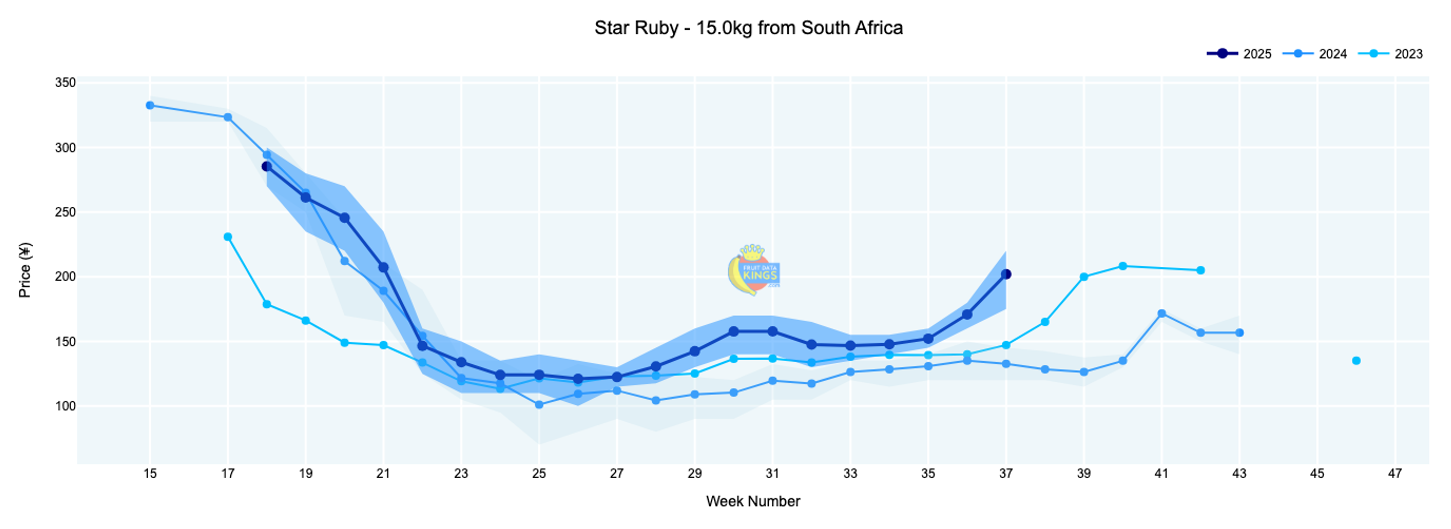

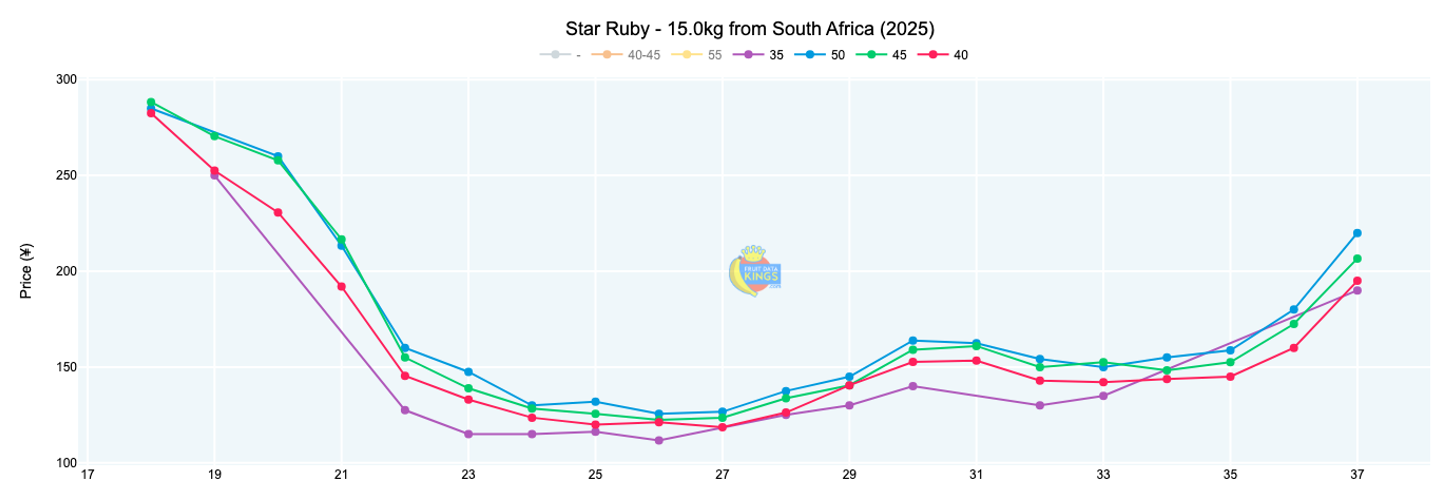

Grapefruit (⇧)

South African Star Ruby pricing strengthened to ¥202 (15 kg), up from ¥171 last week and trading 52% above last year’s levels. A much better season than in recent years! View market data.

Lemons (⇨)

South African lemons remained steady at ¥265 (15 kg), gaining slightly from ¥261 last week and trading 35% above last year. Very few goods were on offer from South America. View market data.

Oranges (⇧)

South African Valencia firmed up this week to average ¥144 (15 kg, various sizes), up from around ¥136 last week. Despite two weeks of continuous gains, we remain 16% below last year’s level. Midknight also strengthened but also remains below where we were last season. Australian navels maintained steady levels compared to the week before. For retail pricing covering major outlets in China, visit us online. View market data.

Soft Citrus (⇧)

There was a strong improvement across the board for soft citrus from both South Africa and Australia this week. South African Nadorcott lifted to ¥176 (10 kg) from ¥155 last week, maintaining its dominant position. Australian goods also lifted in similar fashion, although to date the season has been rather challenging so one week will not be enough to make a real change to final returns. Hopefully this can be sustained as we approach the first week of October. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment