You are here

Back to topFDK China Market Update — Week 32

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

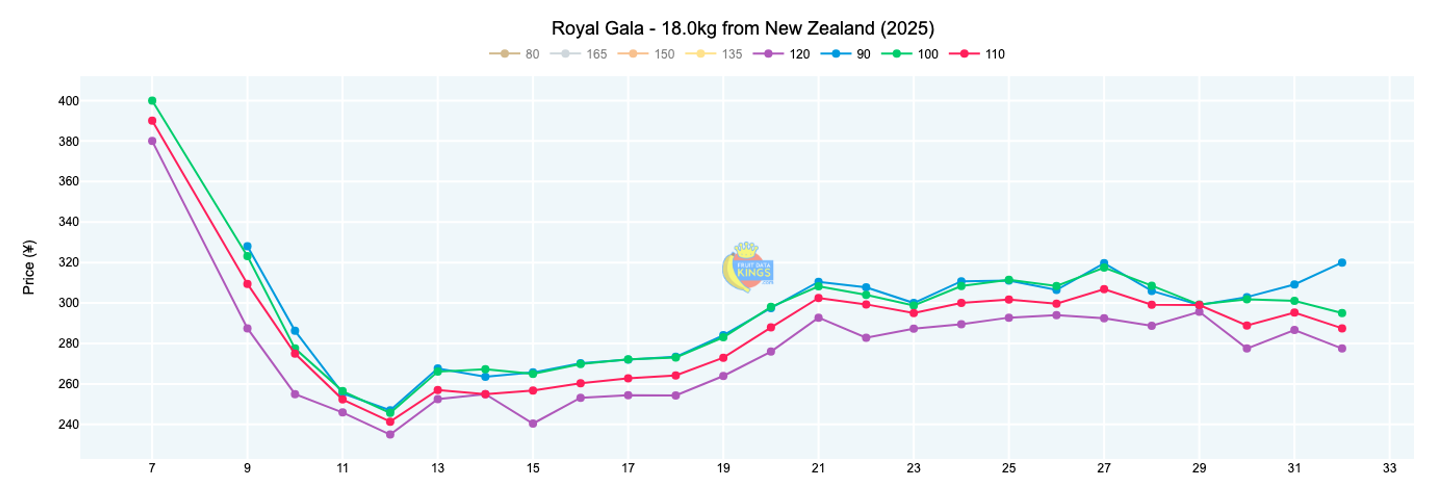

Apples (⇩)

New Zealand maintains its market leadership with 54% dominance over the past three weeks. NZ Royal Gala prices eased to an average of ¥280 (18 kg), down a full 22% compared to last year’s average value and about 10% below 2023. NZ Queen strengthened slightly to ¥313 (18 kg) but remains 10% below 2024 levels. South African Fuji Red averaged ¥249 (18 kg), showing 18% improvement versus last season. For further details on branded apples, South African and Chilean goods, as well as pricing by size, visit us online. View market data.

Blueberries (⇨)

Imports are at a trickle while domestic produce directs the market. At the retail level, we see a price range of between ¥9.90 and ¥29.80 (125 g) in key stores. On average, consumers are paying ¥19.85 per 125-gram punnet. Full price trends can be seen online. View market data.

Grapes (⇨)

Grapes are controlled by Chinese goods with an excellent selection available to consumers. Pricing has been on a steady decline since week 19, when consumers were paying an average of ¥58.00 (1 kg); this in contrast to the current average value of ¥29.50 (1 kg). View market data.

Grapefruit (⇨)

South African Star Ruby pricing remained rather steady at an average value of ¥150 (15 kg), maintaining its 28% premium over the same period of last year and 12% above 2023. View market data.

Lemons (⇨)

The lemon market remains attractive for exporters as values remain firmly above the previous two seasons at 66% higher versus 2024 and similar compared to 2023. View market data.

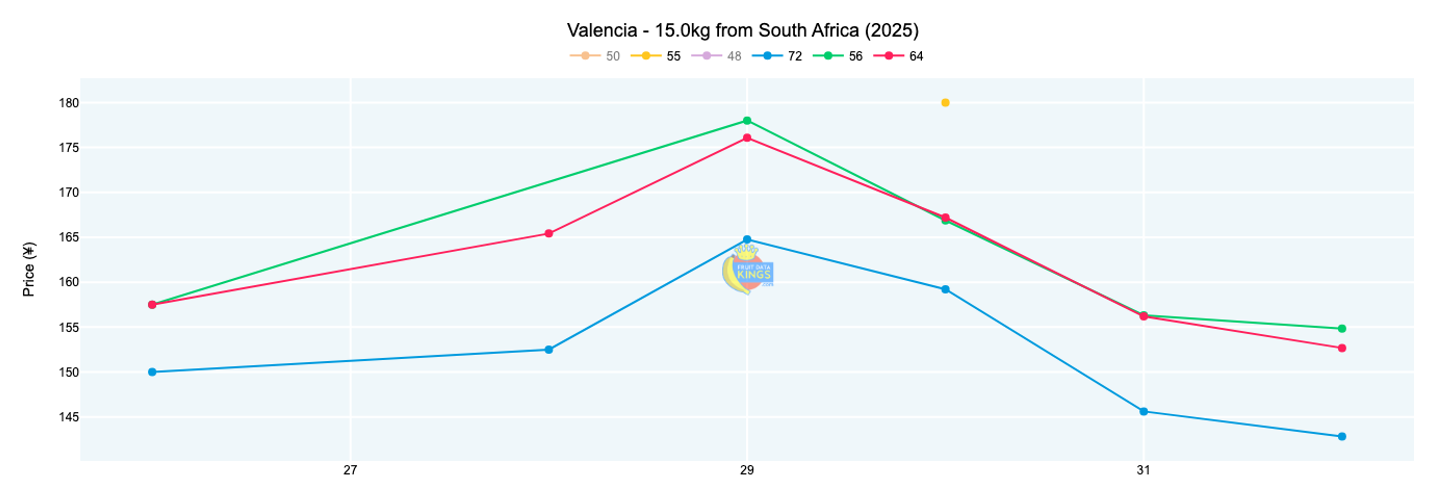

Oranges (⇩)

The orange market experienced broad-based weakness across origins. South African Valencia averaged ¥151 (15 kg), which is strongly below the same week of 2024 but in line with what was seen in 2023. Australian navels declined to an average of ¥216 (18 kg), down 33% versus 2024. Midknight and Cambria varieties from South Africa also weakened during week 32. Full price by size trends are available to members. View market data.

.png)

Soft Citrus (⇩)

The market presents a mixed picture with South Africa holding a dominant position followed by Australia. South African Nadorcott prices softened and are now approximately 26% lower than last year’s pricing. South African Tango declined further to average ¥123 (10 kg). Full details including Australian and Peruvian information can be found online. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment