You are here

Back to topFDK China Market Update — Week 24

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

Apples (⇨)

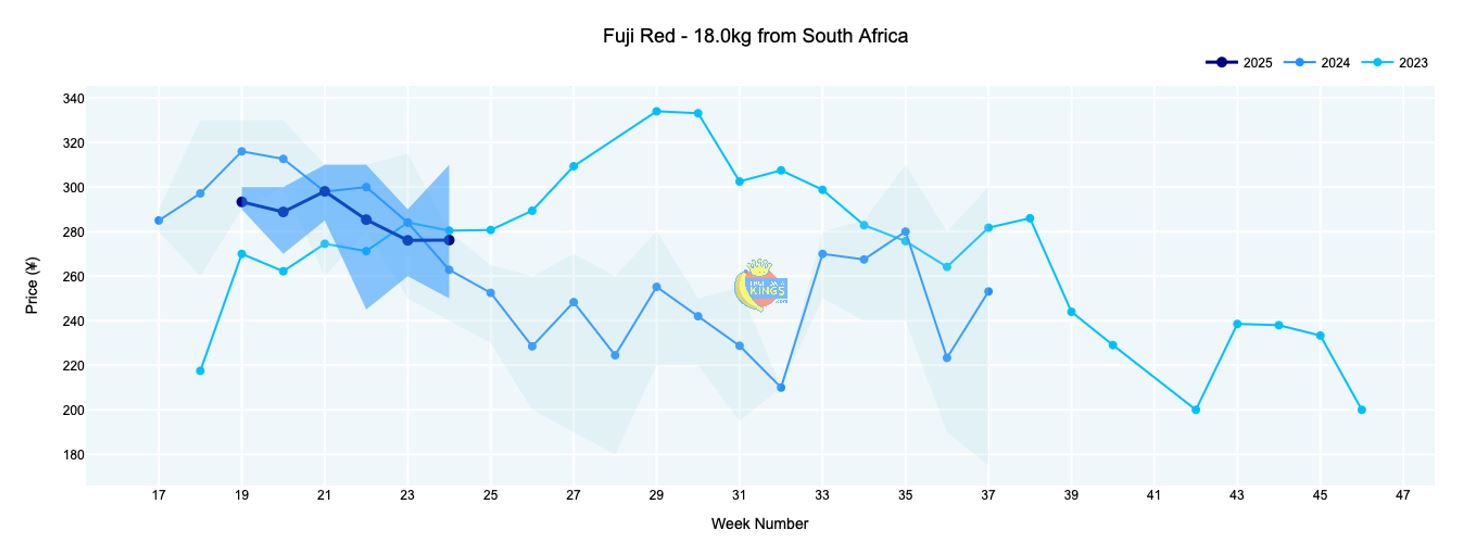

New Zealand continues to dominate the apple market at the wholesale level, although its share has slightly decreased as Chilean volumes show an increase. NZ Royal Gala prices remained rather steady with a modest improvement this week. Pricing is averaging about 6% below 2024 but is above that of 2023. NZ Queen and Dazzle both remained steady; however, the overall average pricing for Queen was below the previous two seasons. South African Fuji Red prices were stable at an average of ¥275 (18 kg, various sizes), which is about 5% higher than last year. At retail, it is rather striking how much dominance New Zealand produce holds compared to its peers from South Africa and Chile. View market data.

Grapes (⇩)

The imported grape market is winding down, with a significant drop in volume. Prices have decreased sharply across most varieties on offer. In retail, one can still see the presence of Chilean, Peruvian, Australian and limited Indian goods, although domestic supply is clearly dominating the offer with good quality too. View market data.

Grapefruit (⇩)

Prices eased this week, averaging ¥125 (15.0 kg), a decrease of about ¥10 from the previous week. Despite the weekly drop, current prices are trading nearly 6% above last year and almost 10% firmer than the 2023 season. View market data.

Oranges (⇧)

This week saw a noteworthy influx of Australian navels, while South African goods have also landed. Egyptian Valencia pricing firmed to ¥180 (15 kg, various sizes), trading significantly higher than last year. South African navels entered the market at a strong ¥220 (15 kg), while Australian navels opened at around ¥286 (15 kg, various sizes). View market data.

Soft Citrus (⇩)

The imported soft citrus market is split between South Africa and Australia. South African Nova prices eased slightly to ¥169 (10 kg) but remain slightly above last year’s levels. The first Australian Royal Honey Murcott (RHM) of the season has entered the market with a wide price range. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body image)

Add new comment