You are here

Back to topPMA Fresh Connections China: 2016’s Market by Fruit Variety

Following her analysis of major changes in China’s imported fruit market by country, Ms. Mabel Zhuang, CEO of M.Z. Marketing Communications, PMA China Development Representative, and founder of Produce Report, continued on to discuss developments among the varieties of fruit being exported to China in 2016 during her keynote address at PMA Fresh Connections: China2017in Shanghai.

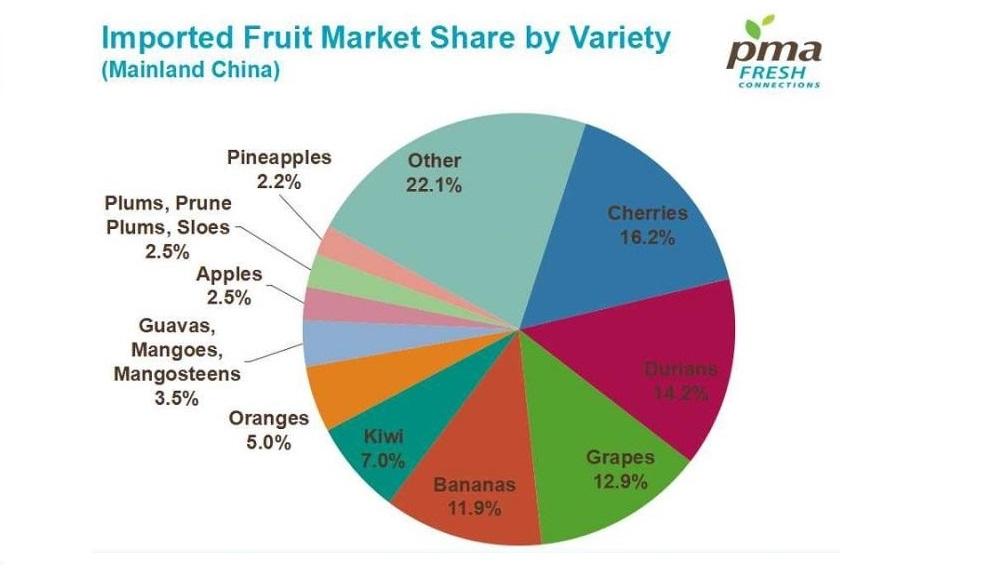

While changes among varieties and categories of fruit in China’s imported fruit market were less dramatic than developments among exporting country-of-origin, there were some important trends in 2016, as Produce Report noted in February 2017. Durians and cherries both increased their market share by 2.8%, accounting for 14.2% and 16.2% of all imported fruit in mainland China by value, respectively. Kiwis and oranges also both experienced market share boosts of 1.7% and now comprise 7% and 5% of the total imported fruit market, respectively. These gains were on the backs of losses by several categories of imported fruit, most notably bananas. Bananas lost nearly 3.5% of their share in the import market and dropped to a total market share of 11.9%. Guavas, mangoes, and mangosteens also gave up ground, dropping by 1.7% to 3.5%. Rounding up the top ten were grapes, which added 1.2% to account for 12.9% of China’s imported fruit, apples, which fell 16.5% in value but only 0.4% in market share to 2.5%, plums, prune plums, and sloes (+15.5% in value and +0.4% in market share to 2.5%), and pineapples (+13.6% in value, +0.3% in market share to 2.2%).

Just outside the top ten categories of fruit imported into China at 11th, avocados once again led in terms of year-on-year percentage growth, recording an impressive growth rate of 73.6% for 2016 and rising from $45.1 million to $78.3 million in value. Across all varieties, growth rates for 2016 were overall more muted than the previous year, with the enormous growth rates enjoyed by small niche markets for 2015 and the past several years absent in 2016. However, China’s imported fruit market continues to show signs of healthy growth, as it was some of the largest and highest-valued imported fruit which recorded the top growth rates in 2016. These included oranges (+46.5%, from $165.3 million in 2015 to $242.2 million in 2016), kiwi (+28.6%, from $266.6 million in 2015 to $342.9 million in 2016), and durians (+22.1%, from $567.9 million in 2015 to $693.5 million in 2016).

In Hong Kong, cherries overtook grapes to be the highest value fruit import for 2016, posting a 60.1% growth rate and rising from $333.8 million in 2015 to $534.4 million in 2016. Cherries’ share of the market similarly jumped, adding 5.4% to 20.5% of all imported fruit in Hong Kong. Partially as a result of these gains, grapes lost some of their market share, falling 2.3% to 17.6%, but still recording a growth rate of 5% for 2016. Other major winners in Hong Kong’s top ten imported fruit varieties included durians (+24.2% in value to $403.2 million, +0.8% in market share to 15.5%), plums, prune plumes, and sloes (+31.2% in value to $73.4 million, +0.3% in market share to 2.8%), and kiwi (+27.5% in value to $55.0 million, but stagnant at just +0.1% in market share to 2.1%).

Taking a closer look at some key product categories, Ms. Zhuang outlined 2016’s major trends in mainland China. For cherries, Chile remained by far the largest source of China’s imports, accounting for 81.6% of all cherries exported to China. The value of Chile’s cherry exports to China also rose by 21.8% in 2016 to nearly $650 million. Chile’s nearest competitor by market share, the United States with a 13% share of the market, only registered 6% growth in its cherry exports in 2016. Chile also rocketed past Mexico with a 432.7% growth rate to become the leading avocado exporter to China, and Chilean avocados comprised 45.6% of China’s imported avocado market by value, compared with Mexico’s 40.5% in 2016. Mexico experienced a decline in its avocado exports to China, falling 16.8% in 2016 to $31.7 million, and may soon be also challenged by Peruvian avocados, which jumped nearly 4,000% from $267,000 in 2015 to $10.9 million in 2016 and captured a 13.9% share of the imported avocado market. Oranges were a growth leader in 2016, as the United States enjoyed a 91.7% increase in the value of its orange exports to China, rising from $39.1 million in 2015 to $74.9 million in 2016 for a market share of 30.9%, up 7.3% from the previous year. Spain emerged as a potential up-and-coming exporter of oranges to China, recording a 266.4% growth rate in value totaling $12.9 million and expanding its market share by 3.3% to 5.4% overall.

Image:MZMC

Add new comment