You are here

Back to topFDK China Market Update — Week 6

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

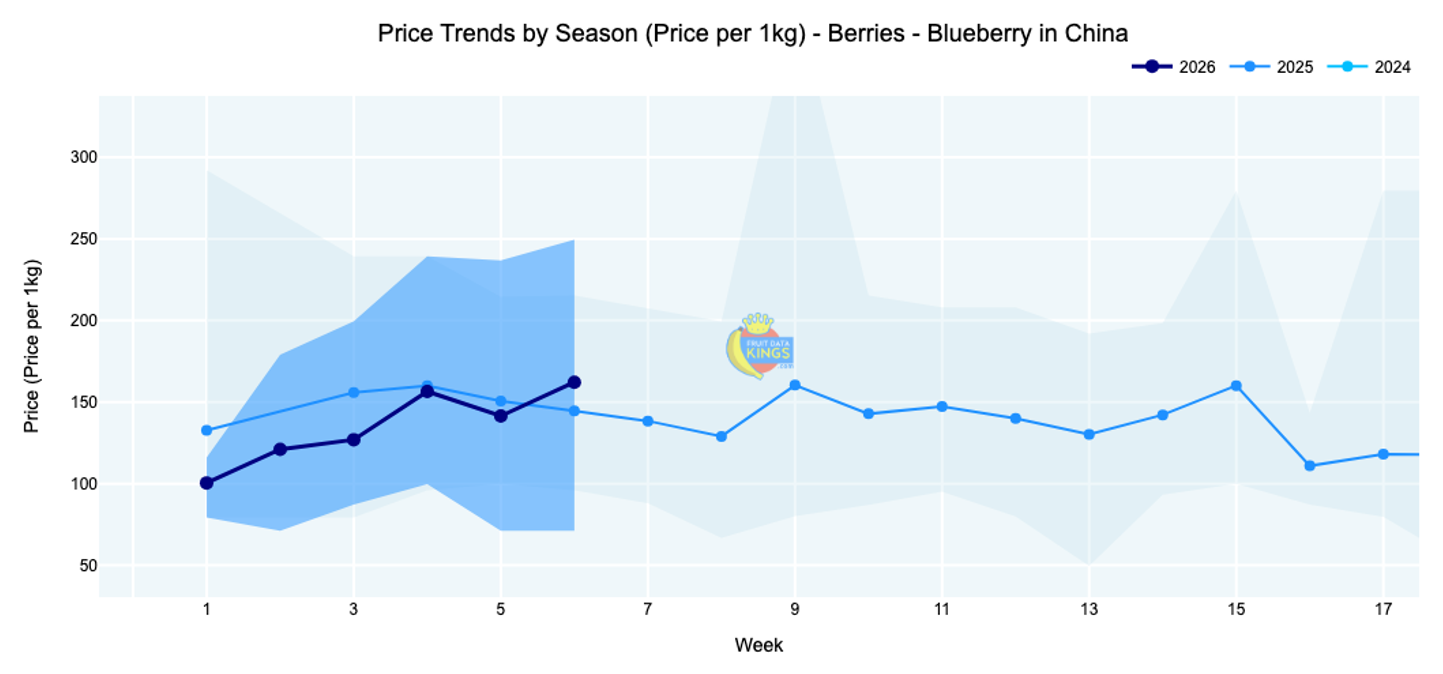

Blueberries (⇨)

From the data captured by Fruit Data Kings, we note that within the berry segment blueberries account for around 40% of the listings across eight notable retailers. This is followed by strawberries (25%) and raspberries (20%). This week, blueberry pricing lifted by $0.35 per punnet to settle at an average value of $2.84 (125 g), which is modestly above last year’s level. Chinese goods still dominate the offer, followed by imported goods from Peru. Full retailer details are available to members. View market data.

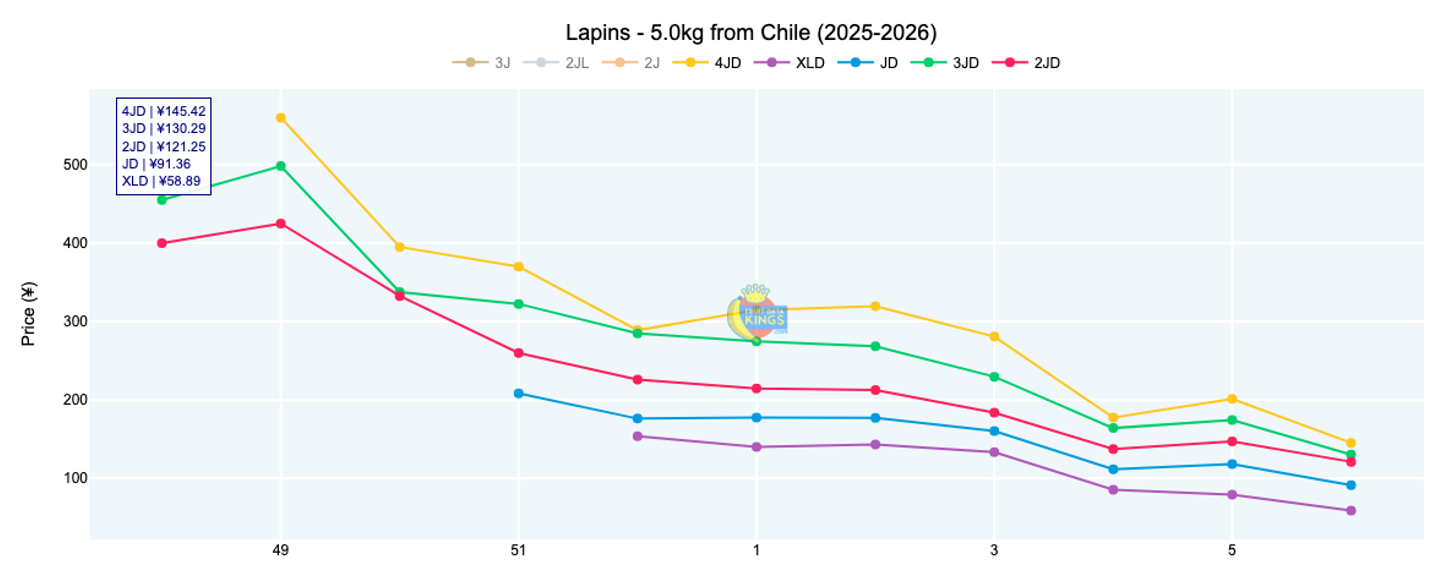

Cherries (⇩)

We are in the final stretch of Chinese New Year sales! This season, while export volumes have been lower than last year, the overall price trend has been similar to that of 2025, which was considerably lower than the 2024 season (60%). It is evident, and has been evident since 2024, that the Chilean cherry industry needs to reconsider its approach to the China market. Between weeks 4 and 6, Lapins accounted for 42% of arrivals at the wholesale level, with Regina increasing sharply and now accounting for about 45% during the same period. Overall Lapins pricing declined by 20% this week to average $16.24 (5 kg), compared with $20.86 last week. Regina also declined sharply from $27.86 to $20.58 (5 kg). At the retail level, pricing lifted slightly to around $37.80 (2.5 kg) across eight well-known chains. Members are able to access wholesale price by size information as well as retail data. View market data.

Grapes (★)

Australian, Chilean and Peruvian grapes are all now available in the wholesale market and at the retail level. Chinese grapes still account for over 50% of the data points from our retailers, followed by Peru and Chile. Retail pricing has in fact lifted for the past three consecutive weeks and is now 33% firmer than last year’s average price at $7.98 (1 kg). Peruvian Sweet Globe and Autumn Crisp have declined in price this week by over 20%. Members are able to access container opening information and price by size statistics. View market data.

Plums (★)

Plum imports are on the increase, with the selection of varieties rather robust. The main variety on offer over the past three weeks remains Candy Pixie, followed by Candy Red. Sugar plums/D’Agen also feature and are earlier than in the previous two seasons but primarily packed in smaller carton sizes (5 kg vs. 9 kg). The abundance of cherries definitely adds a challenge to the plum market, but overall pricing is above that of the previous two seasons. Full market intelligence is available to members. View market data.

Quick links:

Images: Pexels (main image), Fruit Data Kings (body images)

Add new comment