You are here

Back to topA Decade of Horticulture in China: An Interview with Lew Dagger

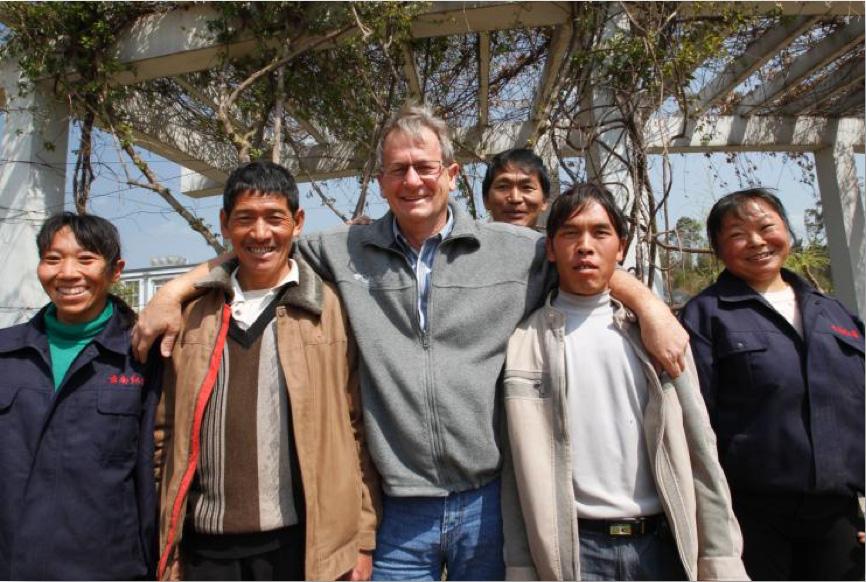

At first glance, Lew Dagger doesn’t look like the sort of fellow who would be invited to meet with high level Chinese officials and give them his unvarnished opinions on the policies they need to pursue to push forward economic development.

Dagger exudes an easygoing and casual bearing cultivated in his native New Zealand and is quick to describe himself as “the farmer in the background” of meetings. Nevertheless, “they got a bit of a hammering,” from himself and other foreign experts, he says of the meeting earlier this year.

A perusal of his CV and last 15 years of experience leads to an understanding of why China’s leadership class would be so interested to hear his opinions on agricultural policy.

”It’s very important from a government policy perspective to be seen as supporting the development of the agriculture industry.”

After spending more than 25 years working in horticulture in New Zealand, Dagger visited China for the first time in 2001 when the government of Yunnan province invited him to evaluate the export potential of a variety of red-skinned pear endemic to some areas of the province. Along with his colleague from the New Zealand Institute of Plant and Food, Allan White, he helped guide the project to commercialize the Red Pear variety within Yunnan, leading to a six-fold increase in the acreage of Red Pear panted in Yunnan, and allowing many farmers to dramatically increase their earnings through planting the new hybrid. He subsequently helped to bring Red Pear genetics to New Zealand where second and third-generation Red Pear varieties are in development.

Dagger left his post as Managing Director of Fresh New Zealand Ltd and moved to China full-time in 2006, basing himself in Yunnan’s capital city, Kunming. He set up his own company, Yunnan Management Ltd, which works with a number of international companies on a range of activities including introducing new fruit varieties to China, commercializing Chinese varietals abroad, developing collaborative breeding programs, managing intellectual property, facilitating the exchange of experts between China and other countries, and bringing modern agricultural and food safety technology to China. Among the clients Dagger represents in China are New Zealand Institute of Plant and Food Research Ltd, Apple and Pear Australia Ltd, the Association of International Growers and Nurserymen (AIGN), Lynch Group Ltd, and Shennong Variety Management Ltd.

One example of Dagger’s achievements in China was to bring together Apple and Pear Australia Limited with growers of Cripps Pink apples in Shaanxi province to sign an agreement that resulted in the growers being granted legal use of the Pink Lady trademark. He has also helped set up floral and berry trial and production operations in China for foreign producers.

Shennong Variety Management, of which he is a shareholder and former Director, and which his company represents in China, has been responsible for the introduction of a significant number of new fruit varieties into China from New Zealand, Australia, USA and Europe.

Earlier this year, it was announced that Joy Wing Mau had taken a shareholding stake in Shennong Variety Management.

Dagger was awarded the prestigious China Friendship Award by the central government in 2009. Out of the more than half a million people working in China under the status of “foreign expert,” the award is normally handed out to only 50 people each year, “who have made outstanding contributions to the country’s economic and social progress.”

Produce Report sat down with Dagger in Kunming to ask him about his time in China and the recent deal with Joy Wing Mau:

Produce Report: As it relates to your own expertise and experiences, what is the aspect of China’s horticulture industry that you think might be most unexpected or interesting to people in the same industry from other countries?

Dagger: I think that people from other countries don’t understand or don’t realize the changes that have taken place in the last ten years, with the development of large, consolidated corporate investment backed by government policy. Most people still see China as a small farmer-based industry, whereas the opportunities and scale in terms of investment and consolidation is huge and accelerating ever faster for a whole variety of reasons. For the next one or two generations, production will still be dominated by small-scale or family type operations. But eventually this model will be supplanted by the development of the corporate-style or big grower type operations.

Another thing people don’t realize is the scale of the investment that’s going into research here. People tend to think about China as bringing everything in. They don’t quite appreciate how much is actually happening here which could potentially end up going out to the rest of the world. The amount of of money that’s spent on research and development here in China in agriculture is massive. Some of it is very high-level stuff, as well.

I think that they also don’t realize how sophisticated some parts of this market are getting in terms of the consumer side. Some of the supermarkets I’ve visited in places like Shanghai and other first tier cities are amongst some of the best supermarkets I’ve seen in the world. But you can also go out and find people selling fruits off a tarp laid on the street. I don’t think in any other country the market operates on so many different levels. The changing consumer demands creates a lot of opportunities.

There’s a perception issue that a lot of foreigners have—especially those who visit from the outside and don’t spend a lot of time here. I actually spend a lot of my time just trying to make people understand and see the opportunity here: but it needs to be more than just a place to sell product. The opportunity is much bigger than that. Just selling product here brings with it all sorts of risks because to have a sustainable business here, you’ve got to bring something to the table which is seen by the government as contributing in a positive way to addressing the issues facing the agricultural sector. It’s very important from a government policy perspective to be seen as supporting the development of the agriculture industry.

Can you share with us a particular accomplishment you’ve made whilst working in China of which you’re proud?

The thing that I’m proud of is that I’ve been able to convince people to come to China and engage in a positive and active way. For example, my work with the Pink Lady brand, the flower production base here in Yunnan, the new varieties, the development of various collaborations between New Zealand Institute of Plant and Food Research and groups within China.

It’s often been a case of getting people to view China as an opportunity rather than a threat. I think if I’ve done anything, I’ve done that in a small way.

If you had to pick one piece of advice for international growers looking to set up their own production or license their varietals in China, what would it be?

The first thing is for them to find someone who’s got some experience with the type of project they’re looking to engage in, and can give them some overall advice. Particularly in the agriculture business, that’s not someone in Shanghai. You’ve got to move into the geographical areas of particular interest to you.

I work on the principle that the longer I’m here in China, the less I understand. One thing I know now, there’s no expert on China—it doesn’t exist. So finding a mentor is really important. Someone that you can share ideas with and can give you direction about how to approach things.

If you don’t approach things in the right way here, you’ll spend an awful lot of time getting nowhere.

In your view how successful have Chinese breeders been at monetizing their varietals abroad and what steps could they take to improve in the future?

In the fruit business this has not happened and there are a number of reasons for it including government policy, program focus and local market demands. To achieve a result, I think that they need to take the opportunities of connecting with organizations all over the world like AIGN and doing same thing I talked about in terms of foreign operations in China, but going the other direction: finding people that can act as guides and mentors. They should be working more closely with international breeders and having a much more collaborative approach.

One thing holding this process back is that China, in terms of R&D, still has a lot of the old aspect, where research is done for research’s sake rather than, ‘what are the commercial outcomes and what are the commercial opportunities?’ It’s a generalization, but one finds that among research institutes, there’s not a focus on the market. And at the end of the day it’s important that research be driven by market opportunities. There are of course exceptions: for example, in kiwifruit, you’re starting to see some quite exciting developments.

How did the recent deal with Joy Wing Mau come together?

I have known Golden Wing Mau for a number of years. My first introduction to them came nearly ten years ago, through one of their shareholders, Capespan of South Africa, who had previously been one of my customers when I was working in the New Zealand industry.

So I knew some of the people that were working with Golden Wing Mau. I met them and I met the leader and President, Mr Liu Mau-Wah, and started to develop an understanding of the Company. I was very impressed by what I learned and saw. They were advanced in their thinking, their understanding of the market and the whole supply chain, and branding. After that I met them on a number of occasions and got to know Golden Wing Mau pretty well. Then I started introducing them to the new varietal technology that we were bringing to China, though that was really at quite the early stages of what I was doing here. Liu clearly understood the importance of new technology and new varieties and started to express some interest in it.

As far as Shennong Variety Management was concerned, we always realized to be successful in China that we would have to take on a local partner. We could take it to a certain point, but when it came to the commercialization, that it was important to have a local partner who understood, had the connections, and could manage things. So we were always thinking about and looking at what our options were.

We started to talk the idea out and explore the option with Golden Wing Mau probably about two years ago. We go into serious negotiation with Joy Wing Mau about a year ago, which resulted in them taking up part of the shareholding in the company, which was formalized at the start of this year.

As we got to know and see and discuss things with GWM and then more after the merger with Joyvio, and the formation of Joy Wing Mau. We saw that strategically it fitted with where we’re going. We saw great benefits in being able to work with a company that had significant distribution and marketing expertise, so that we could actually integrate into a sales chain. Joy Wing Mau has also brought a lot of production capacity and expertise into the combined company, so that we have the opportunity either to operate on a number of levels in a fully integrated system right up from nursery through to marketing, or to come in at various levels.

It’s important to be able to do that because, obviously, for international variety owners, their key questions always come back to: one, control and two value. And if you can’t demonstrate you can do both those things, it’s not going to happen. A powerful company like Joy Wing Mau brought that added benefit to us.

Add new comment