You are here

Back to topChilean Avocado Production To Remain Level in Coming Years

As the 2022/23 Chilean avocado season wraps up, the production volume is estimated to reach approximately 186,000 metric tons, marking a decrease from the 220,000 metric tons registered last season. According to Francisco Contardo, executive director of the Chilean Avocado Committee, this season’s output was impacted by severe spring frosts, which were unforeseen and caught growers unprepared. The frosts reportedly caused some farms to lose their entire crop.

Owing to a range of adverse factors, the industry does not expect any growth in production in the short term. Contardo anticipates that crop volumes will remain at the present level, with minor fluctuations observed from year to year.

Climate change, reputation damage, investment cuts

As desertification in Chile proceeds and barren lands advance from north to south, many growers have been forced to relocate to more southern regions of the country. However, besides avocados, various other fruits are grown in southern Chile, which means that the space available for avocado production has shrunk compared with several years ago. Urbanization has also consumed large amounts of agricultural land. This decline in planting areas, exacerbated by extreme weather events such as last September’s frosts, has limited production.

Furthermore, since 2018, the Chilean avocado industry has been fiercely criticized for its water consumption. Contardo recalled allegations of up to 18,000 liters of water being required to produce one kilogram of avocados, which he described as “ridiculous” and the equivalent of using a swimming pool to grow four avocados. According to one study by Chile’s Institute of Agricultural Research, the actual figure is much lower — 410 liters per kilogram. These data as well as other scientific reports on the eco-friendliness of avocado cultivation have helped the industry to become less defensive and more proactive in applying sustainable growing practices. Nonetheless, such claims have at times negatively affected the industry’s reputation and discouraged some farmers from pursuing avocado cultivation.

An additional disincentive came several years ago with the loss of government support in the form of tax benefits and other privileges for hillside crops, which previously helped to encourage both local and foreign investment into the agricultural sector. According to the Chilean Avocado Committee, 80% of avocado plantations are situated on hillsides.

Current markets rather than new ones

Climatic changes have impacted not only the production volumes but also the seasonality. Previously, Chile and Peru had well-defined export windows, with Peruvian shipments ending in September and Chile taking over in the same month. Recently, however, shifting weather patterns have led to overlapping export seasons. Both countries now begin harvesting their avocados around September, which means that they reach overseas markets at the same time. This problem is exacerbated by the fact that Chile and Peru share the same key export markets, namely, the European Union, the United States and China.

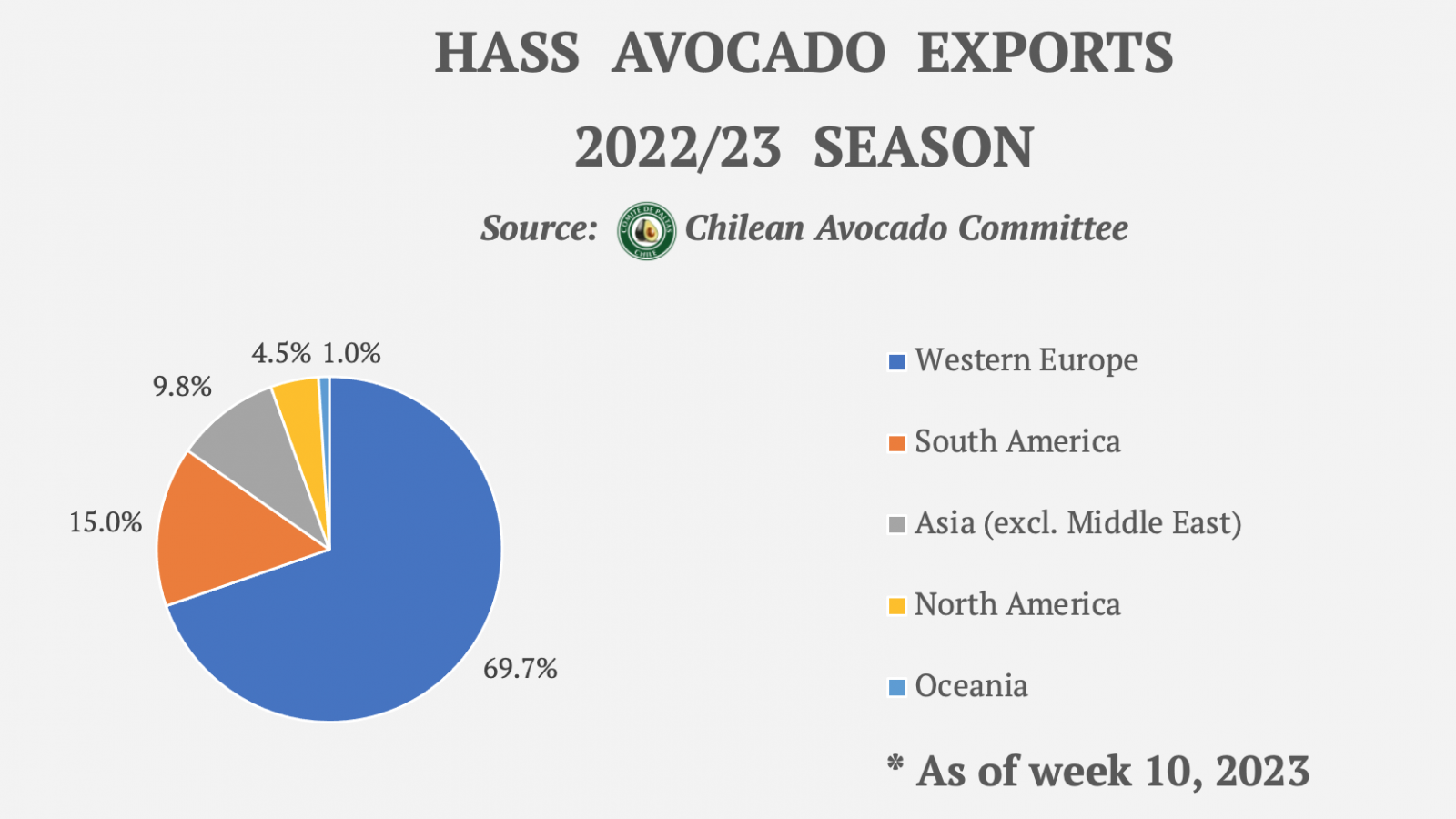

According to Contardo, Chile’s main avocado export market is Europe, with a share of about 69% in 2021/22, followed by Argentina and China, which accounted for 15% and 7.4%, respectively, of total exports. Several new markets have opened up for Chilean avocados in the past two years, including Australia, South Korea and India. Other export destinations could potentially join the list in the coming years, but, as the prospects for expanding production are relatively low, the committee has reportedly decided to focus on expanding the presence of Chilean avocados on existing markets rather than attempting to open up new ones.

It is also important to note that the pandemic generated significant growth in Chile’s domestic avocado consumption, which increased from 7.4 kilograms per capita to 10–10.2 kilograms per capita. In this regard, a substantial part of this season’s crop is expected to remain in the country to supply the domestic market. By the end of the season, Contardo expects that approximately 100,000 metric tons (54%) will have been exported, while the remaining 86,000 metric tons (46%) will have been consumed domestically.

Images: Pixabay (main image); Chilean Avocado Committee, translated by Produce Report (body image)

Add new comment