You are here

Back to topAfter Cyclone, New Zealand’s Apple Industry Prioritizes Asian Markets

The damage wreaked by Cyclone Gabrielle in February has had a significant impact on this year’s apple production in New Zealand. According to the New Zealand: Fresh Deciduous Fruit Semi-annual report released by the U.S. Department of Agriculture’s Foreign Agricultural Service on May 18, New Zealand’s apple exports are expected to decline sharply this year. To offset the resulting losses, the country’s apple industry is anticipated to prioritize premium markets, as well as replacing lower-value varieties with the higher-value varieties preferred by Asian markets, including China, Thailand and Vietnam.

Striking in early February, Cyclone Gabrielle reduced New Zealand’s apple cultivation area from 10,300 hectares to just 8,900 hectares. The worst-hit areas were Hawke’s Bay and Gisborne, New Zealand’s largest apple production regions, which together account for around two-thirds of the country’s production. The strong winds and heavy rains accompanying the cyclone caused severe landslides and flooding and left behind large deposits of silt, resulting in extensive damage to both orchards and infrastructure.

According to the latest statistics from industry association New Zealand Apples and Pears, 840 hectares of apple orchards in Hawke’s Bay were wholly destroyed and require complete redevelopment, another 1,260 hectares were submerged and remain heavily silted, and a further 1,800 hectares suffered extensive water damage and will see a significantly reduced harvest. Around a quarter of the region’s apple trees were destroyed, with yields expected to be severely affected for almost another quarter of the trees.

While the cyclone hit the Hawke’s Bay and Gisborne regions, other South Island production areas, such as Nelson, have seen near-optimal conditions this year. The return of overseas workers following the coronavirus pandemic and ideal weather conditions during the harvest season led to fewer apples being left on the trees. Over the past few seasons, investments have driven innovation in the industry, along with the automation of many jobs in farms and packhouses. Despite these improvements, overall production in 2022/23 is now forecast at 453,000 metric tons, the lowest level since 2009/10.

The apple harvest season in New Zealand runs from January to June, with the peak harvest period from March to May. Cyclone Gabrielle hit at the beginning of the harvest season before most apples had been picked. Reduced production in Hawke’s Bay will significantly reduce New Zealand’s apple exports to global markets. Exports are now forecast at 270,000 tons, down 21% compared with the 2021/22 season.

Despite the devastation in Hawke’s Bay, neighboring Napier Port was able to continue operations and shipping to global markets. In March, in the wake of the cyclone, exports from Napier Port fell by 17% compared with the same period of last year. Napier Port usually accounts for 61% of New Zealand’s total apple exports, followed by Tauranga with 17% and the South Island ports of Nelson and Dunedin with 14% and 4%, respectively.

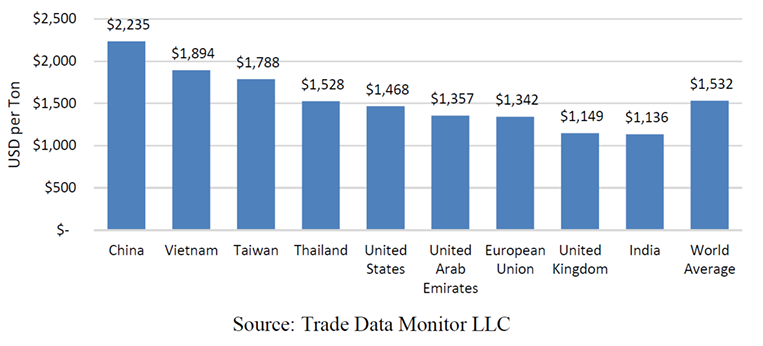

Owing to the anticipated decline in export volume, New Zealand’s apple industry is expected to prioritize higher-end markets to ensure maximum export revenue and offset losses from this year’s reduced production. Asian markets typically import the highest-value apples from New Zealand, while markets in Europe and India import the lowest-value apples.

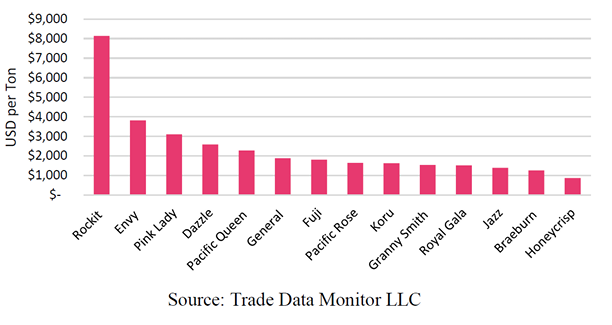

In recent years, the industry has adopted an overall strategy of replacing older, lower-value apple varieties such as Braeburn with higher-yielding varieties, especially those favored by Asian markets. This shift is expected to accelerate as producers in Hawke’s Bay rebuild their destroyed orchards. With the industry still reeling from the damage caused by the cyclone and the previous labor shortages brought on by the pandemic, producers are likely to select more profitable varieties for replanting. As a result, a significant decline in older varieties such as Royal Gala and Braeburn is anticipated, coupled with an increase in higher-value varieties such as Rockit, Envy, Dazzle and Pink Lady.

Images: Unsplash (main image), USDA Foreign Agricultural Service (body images)

This article was translated from Chinese. Read the original article.

Add new comment