You are here

Back to topFDK China Market Update — Week 15

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website.

Apples (⇩)

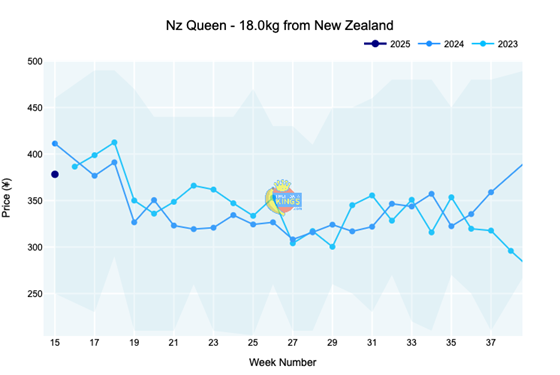

New Zealand continues to dominate the apple market with an 83% share of total openings over the past three weeks, increasing to 89% in the current week. Royal Gala remains the leading variety (38%), with NZ Queen and Dazzle (both 11%) gaining prominence this week. NZ Royal Gala has averaged ¥254 (18 kg, various sizes), trading 7% below last year but 11% above 2023. NZ Queen has started slightly lower than last year with an average value of ¥379 (18 kg, various sizes/grades), while Dazzle is trading at ¥421 (18 kg). South African Royal Beaut has maintained its pricing at ¥239 (18 kg), trading 11% above last year. For further details including retail pricing, visit us online.

Grapes (⇩)

Chile and Australia dominate the grape supply, with Peru in third position. The current week shows increased Chilean dominance, while the Peruvian share has decreased to 7%. Sweet Globe has been dominant over the last three weeks, followed by Crimson and Red Globe. Chilean Red Globe is trading at ¥180 (8.2 kg), 22% below last year, while Australian Crimson remains stable at ¥231 (9.5 kg). Chilean Crimson has strengthened to ¥163 (7.3 kg) but is not very well supplied. Peruvian Sweet Globe is hovering around the ¥236 (7.3 kg) mark, which is firmer than last season, while Australian Sweet Globe has decreased to ¥255 (9.5 kg). Additional details are available online.

Nectarines (⇧)

Chilean nectarines have seen a sharp volume decline in southern China. Arctic Mist, Sweet Giant and Arctic Snow account for the bulk of supply over the last three weeks. Arctic Snow currently trades at ¥149 (9 kg), 27% below last year. Majestic Pearl prices have improved to ¥69 (9 kg) from last week’s low point, while Giant Pearl has decreased to ¥65 (9 kg). The market shows significant price separation between key varieties.

Oranges (⇧)

Orange volumes have decreased significantly this week, with the market transitioning between origins. Three-week data show the United States (56%) and Egypt (44%) sharing supply in southern China. Egyptian Valencia prices have firmed up to ¥145 (15 kg), representing a 16% premium over last year and 18% above 2023. Visit us online to view additional information, including retail pricing.

Plums (⇧)

Chilean plums continue as the exclusive supply, though volumes have decreased. Sugar plums/D’Agen dominate the market, followed by Sweet Mary and now Crimson Fall. Prices have strengthened dramatically across varieties: sugar plums now trade at ¥261 (9 kg, +123% year on year), D’Agen at ¥245 (9 kg, +142% YOY) and Sweet Mary at ¥279 (9 kg, +46% YOY). Pink Delight prices have also improved to ¥187 (9 kg, +33% YOY), while Crimson Fall prices have eased slightly to ¥162 (9 kg) but remain 27% above last year.

Quick links:

Image: PickPik

Add new comment