FDK China Market Update — Week 52 [1]

Submitted by Produce Report [2] on

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website [3].

Blueberries (⇩)

This week, we have noted a general softening of prices across varieties from Peru. The variety selection remains robust, with Magica accounting for 50+% of recorded openings over the last three weeks followed by Ventura, Bianca, Sekoya Pop and others. All varieties are mostly following the price trend of 2024, which is around 30% lower than the same week of 2023. Chinese blueberries are readily available at retail and account for 60% of the recorded goods. Presently, retail pricing is similar to 2024 at an average of ¥16.10 (125 g). Further details are available to members. View market data [4].

Cherries (⇩)

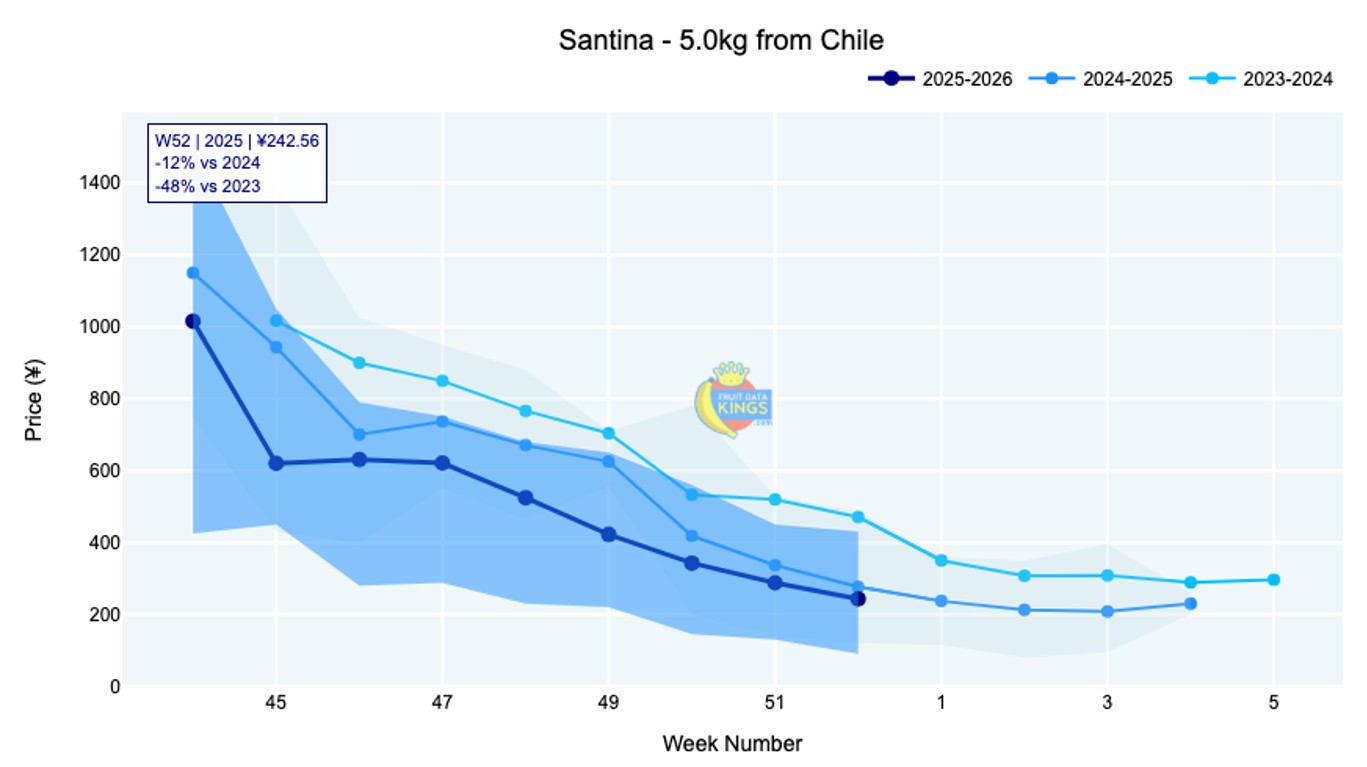

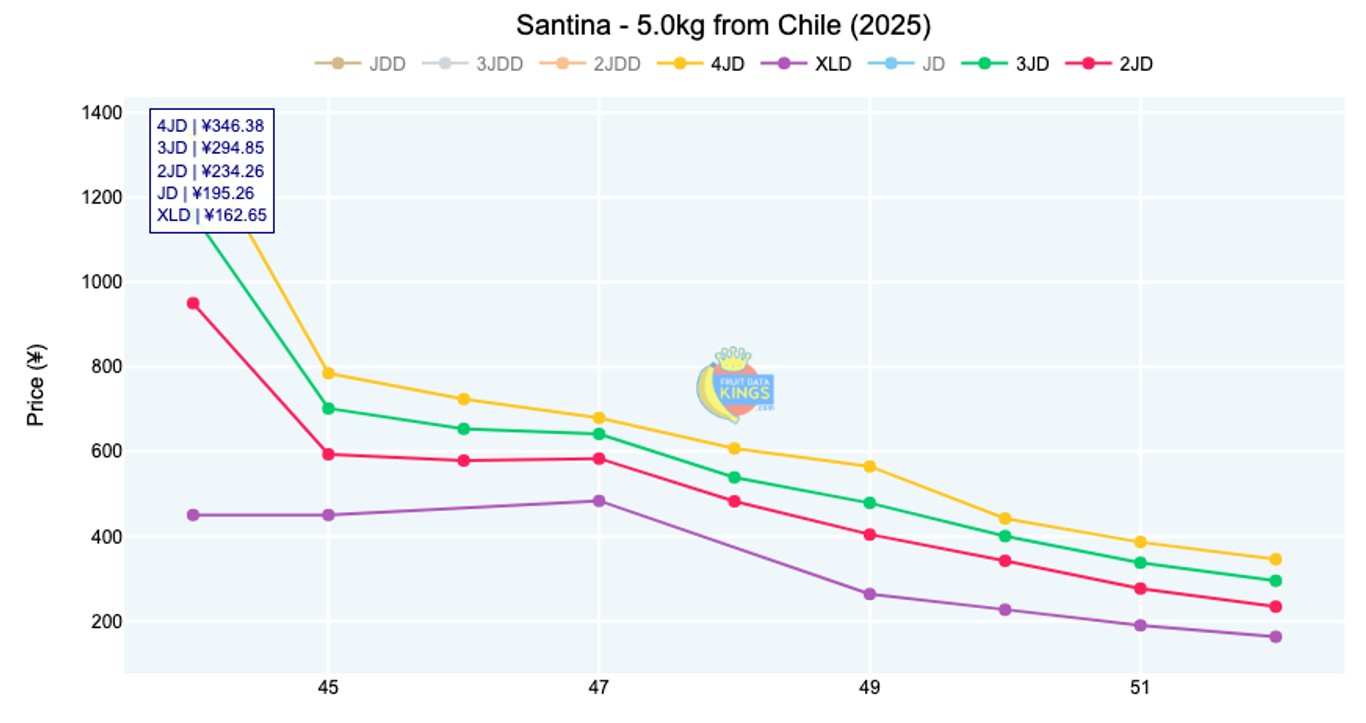

Over the past three weeks, Santina has clearly dominated the offering (80+%), followed by Lapins with less than 5% of recorded openings. On average, five-kilogram Santina and Lapin pricing declined by 14% to 21% this week, corresponding to ¥40 per carton. The season has generally shown better quality than last year, although movement has not been spectacular and is considered “okay”. At present, Santina (5 kg) is trading 12% below the same week of 2024 and a full 48% below 2023. Members can view price by size details as well as retailer pricing details online. View market data [5].

Plums (★)

The first plums from Chile have arrived, with a very well known brand featuring in the market. Candy Pixie opened at around ¥380 for 4J (2.5 kg) and ¥430 for 5J (2.5 kg). Fruit Data Kings will be monitoring Chilean plums as we enter into 2026. View market data [6].

Quick links:

- Apple [7]

- Blueberry [8]

- Cherry [9]

- Grape [10]

- Grapefruit [11]

- Nectarine [12]

- Orange [13]

- Pear [14]

- Plum [15]

- Soft Citrus [16]

Images: Pexels (main image), Fruit Data Kings (body images)