You are here

Back to topChilean Stone Fruit, a New Rising Star in China

On February 20, several representatives from the Chilean fruit industry came together at Guangzhou Jiangnan Wholesale Market to participate in a Stone Fruits from Chile workshop involving 50–60 importers, wholesalers, distributors, and buyers. Produce Report was in attendance at the event, where Charif Christian Carvajal, Director of Marketing for Europe and Asia at the Chilean Fruit Exporters Association (ASOEX), Gonzalo Matamala, General Manager of GESEX China, and Juan Puntí, Quality and Postharvest Manager at Exportadora Prize Ltda. shared their insights into the Chilean stone fruit sector and provided practical guidance on how to handle and promote stone fruit from Chile. The seminar was also live streamed on the Yizhibo platform and is now available for viewers to watch.

As the largest exporter of fresh fruit in the southern hemisphere and with fresh fruit exports totaling 5.2 billion USD (2.7 million tons) in 2018, Chile is a major player in the global fresh produce sector. More than 30 different species of fruit are grown in Chile and shipped to over 1,700 fruit importers and distributors in more than 100 countries.

Stone fruits from Chile are typically available from the end of December to late March or early April. As Mr. Carvajal explained, China represents a large market for Chilean stone fruit, with approximately 74% of fresh plums (40,620 tons) and 49% of fresh nectarines (8,780 tons) imported into China in the 2016–17 season originating from Chile.

Plums accounted for 4.3% (120,685 tons) of fruit exports from Chile in the 2017–18 season, and Asia was the main destination region (43,695 tons, 36%), of which China represented the main market (41,319 tons, 95%). The main varieties of plums exported to China are D’Agen (15.5%), Angeleno (15.2%), sugar plums (11.3%), and Crimson Fall (8.1%). In particular, the export volume of sugar plums, a unique variety with high sweetness that is typically available from the end of January to early March, to China is expected to show a several-fold increase this season, with approximately 1,500 containers already dispatched as of last week. This large increase originates from the popularity of Chilean sugar plums with Chinese consumers, who are already familiar with this product as it is the same variety as that grown counter-seasonally in Xinjiang, and further year-on-year volume increases are expected.

Meanwhile, nectarines accounted for 2.4% (66,634 tons) of Chile’s fruit exports in 2017–18, with Asia (20,575 tons, 31%) and China (16,654 tons, 81%) being the main destination region and destination market within Asia, respectively. The main varieties of nectarines exported to China are the white-fleshed Bright Pearl (12.7%), Giant Pearl (11.5%), Arctic Snow (11.5%), and Magique (10.9%), and the yellow-fleshed Venus (6.3%).

In addition to exporting to the Chinese market, the Chilean produce sector is also proactively engaged in promoting and increasing the consumption of Chilean fruit in China. This year, the Chilean Stone Fruit Committee of ASOEX has implemented a promotional campaign under the slogan “spring up your life with stone fruit from Chile”. This campaign will take place from February to April and aims to position Chilean stone fruit as a healthy alternative after Chinese New Year, via point-of-sale activities with leading retailers, advertising in specialized trade media, promotions on major e-commerce platforms, and workshops at both the trade and retail levels across China.

Mr. Matamala provided further insights regarding the steps needed to bring high-quality fresh stone fruit to China, explaining that two technologies – modified atmosphere packaging (MAP) and controlled atmosphere (CA) containers – are typically used to prolong freshness and delay deterioration, and that the most crucial aspect is to maintain the cold chain consistently from the packing facility to arrival in China. Any interruption of the cold chain, such as during repeated unloading and loading of pallets, can have a direct impact on the temperature and moisture levels within the shipment and ultimately decrease shelf life. This is especially the case after Chinese New Year, when slower vessels are used to transport the produce and the temperature upon arrival is slightly higher. Under optimum conditions, a shelf life of 7–10 days after arrival is feasible; however, care has to be taken to avoid the temperature reaching the “killing zone” of 3–7 °C, which is the worst-case scenario for stone fruit and can lead to rapid deterioration.

Mr. Puntí endorsed these points and the criticality of ensuring the right post-harvest temperature, such as by shipping smaller volumes to stores to maintain the cold chain for as long as possible. He also pointed out that importers need to be closely aware of the product they are receiving and how to best handle it, as different exporters use different technologies. This is especially the case with sugar plums, with approximately 50–60 companies now exporting this product to China to meet the increasing demand.

According to Mr. Matamala, buyers and consumers also need to be educated about the varying characteristics of fruits from different origins. For example, European nectarines tend to be slightly darker and contain white “sugar spots” that are indicative of high Brix levels and a better eating experience, although customers unaware of these properties may be reluctant to buy such fruit. Likewise, preconditioned nectarines, which Chile already exports to Europe and the U.S., may take some time to find acceptance in China as they can be considered too soft by consumers despite possessing higher juiciness. Similarly, Mr. Puntí explained that certain varieties of plums need to be harvested when slightly softer, and consumers need to be made aware that this can lead to a superior eating experience.

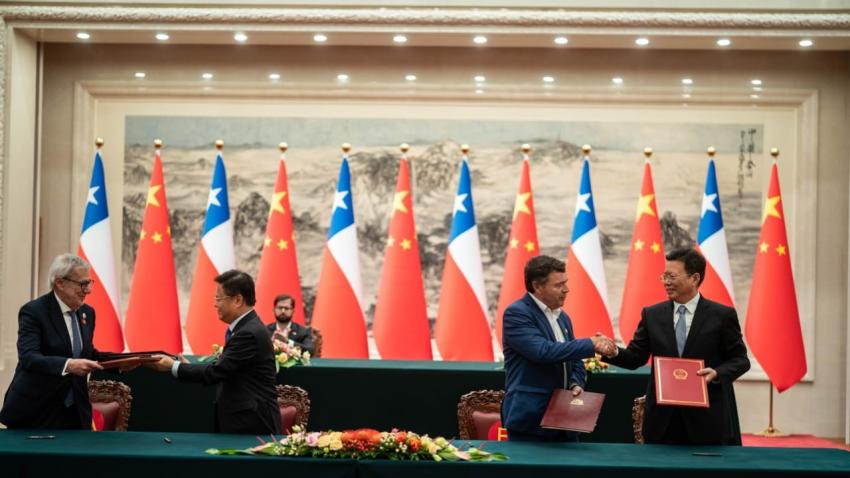

Image source: MZMC

Add new comment