FDK China Market Update — Week 43 [1]

Submitted by Produce Report [2] on

This newsletter is published on behalf of Fruit Data Kings, a Berlin-based company specializing in pricing data and associated analytical tools for the fresh produce industry. For more information, visit the Fruit Data Kings website [3].

Apples (⇨)

The Southern Hemisphere apple season is all but over, with stocks currently playing a major role. These stocks are sitting at the retail level, in cold rooms and at wholesale. In Chinese retail, New Zealand commands a dominant position compared with other Southern Hemisphere exporters, comparable only with domestic Chinese apples in terms of shelf space. For full wholesale pricing for the season as well as retail details, visit us online. View market data [4].

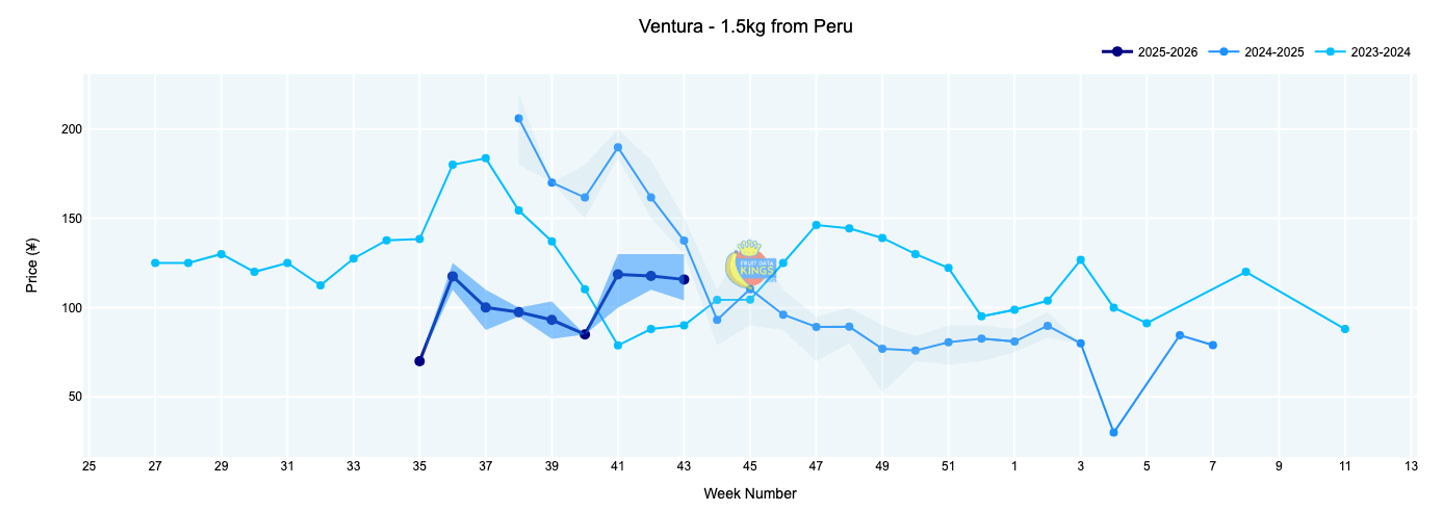

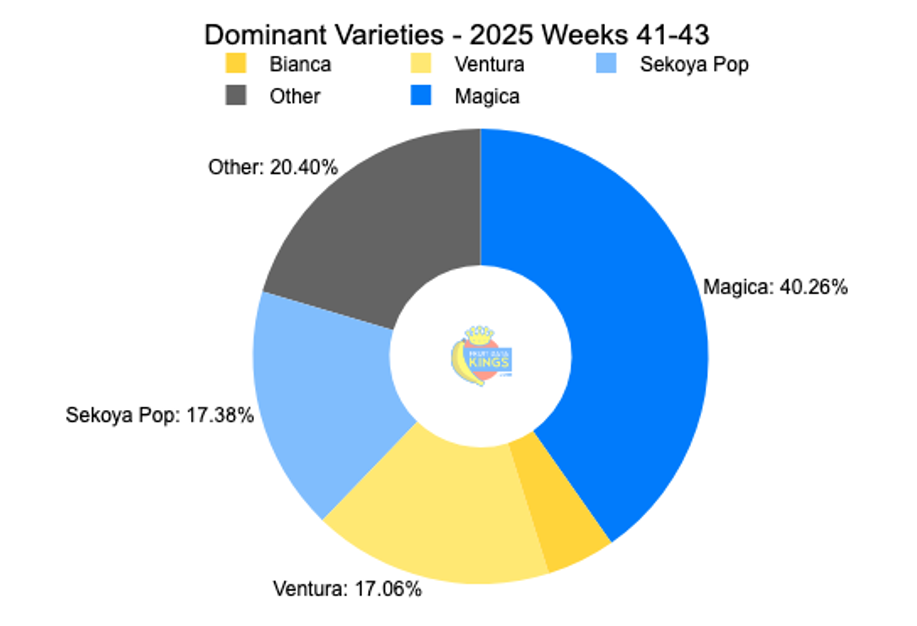

Blueberries (⇩)

After the price improvement registered in week 41, the market has been steady with a slight decline in weeks 42 and 43. In week 43, most blueberry varieties decreased in price by ¥5–10 on average. At the retail level, taking into account a basket of eight retailers, the average price sits at ¥16.25 (125 g) compared with a value of over ¥20.00 (125 g) in the same week of last year. Full details are available to members. View market data [5].

Cherries (★)

The 2025/26 cherry season is in its second week, with a flurry of varieties such as AG2, Black Rock, Nimba and Royal Dawn available. While these varieties featured at wholesale, some early-season cherries with a tendency to show softness were directly taken to retailers and second-tier markets for sale. View market data [6].

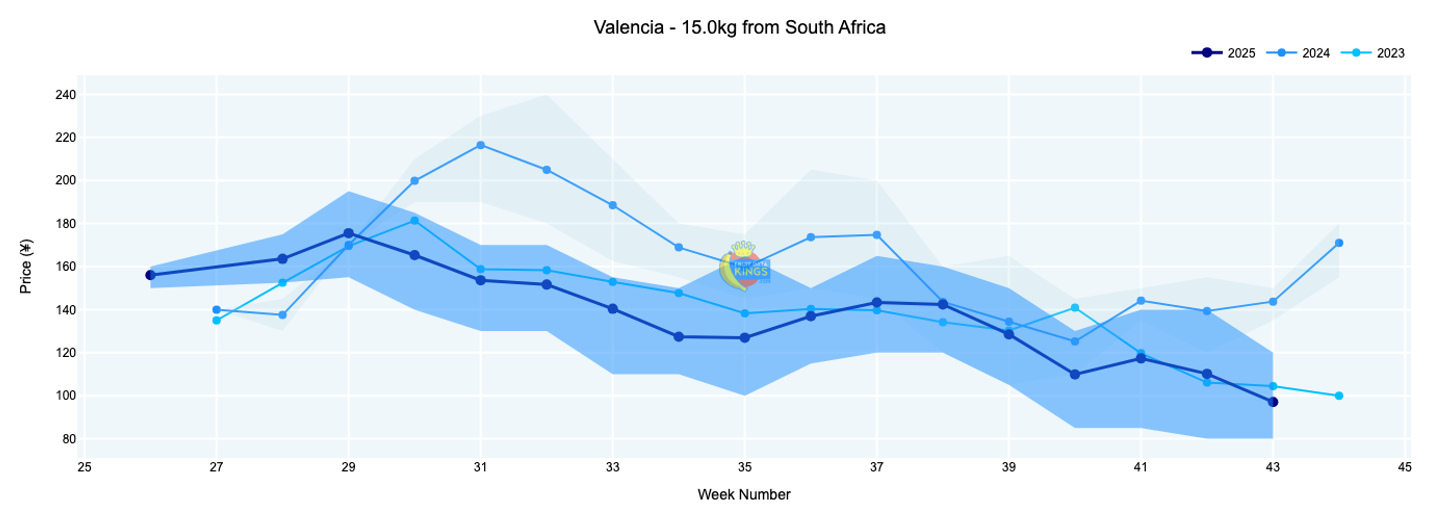

Oranges (⇩)

The orange market remains challenging with pricing declining across the board in week 43. South African Valencia averaged ¥97 (15 kg, various sizes) as Midknight oranges traded slightly better, both trading similar to 2023 levels, which were 32% below the same week of 2024. Details for navel oranges from both Australia and South Africa are available online. View market data [7].

Soft Citrus (⇨)

Australian imports continue to open on the market, while South African goods are primarily coming from stocks. In retail, Australian goods have a good market share while leading South African brands are also making a visible impact. Across a basket of eight retailers, imported mandarins averaged ¥34.70 (1 kg). View market data [8].

Quick links:

- Apple [9]

- Blueberry [10]

- Cherry [11]

- Grape [12]

- Grapefruit [13]

- Nectarine [14]

- Orange [15]

- Pear [16]

- Plum [17]

- Soft Citrus [18]

Images: Pexels (main image), Fruit Data Kings (body images)